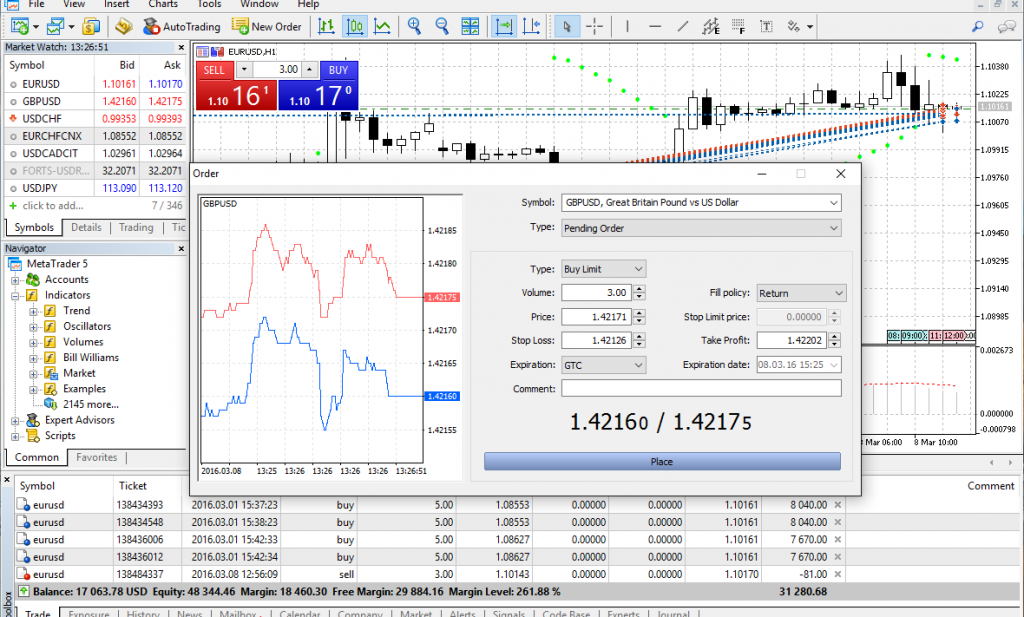

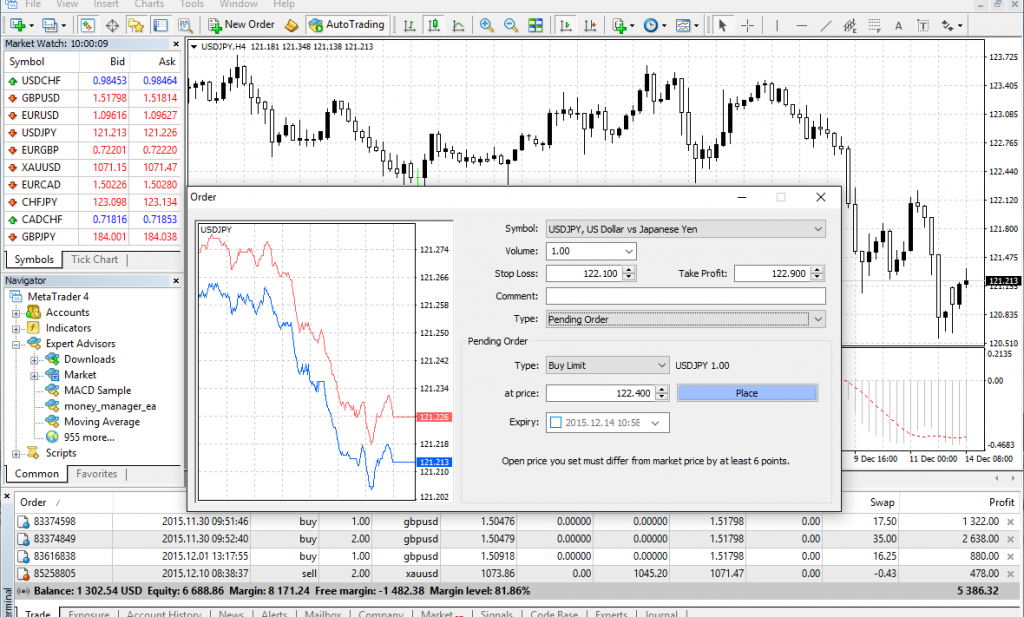

How to Adjust Stop Loss and Take Profit Levels during a Trade in MetaTrader 5 (MT5)

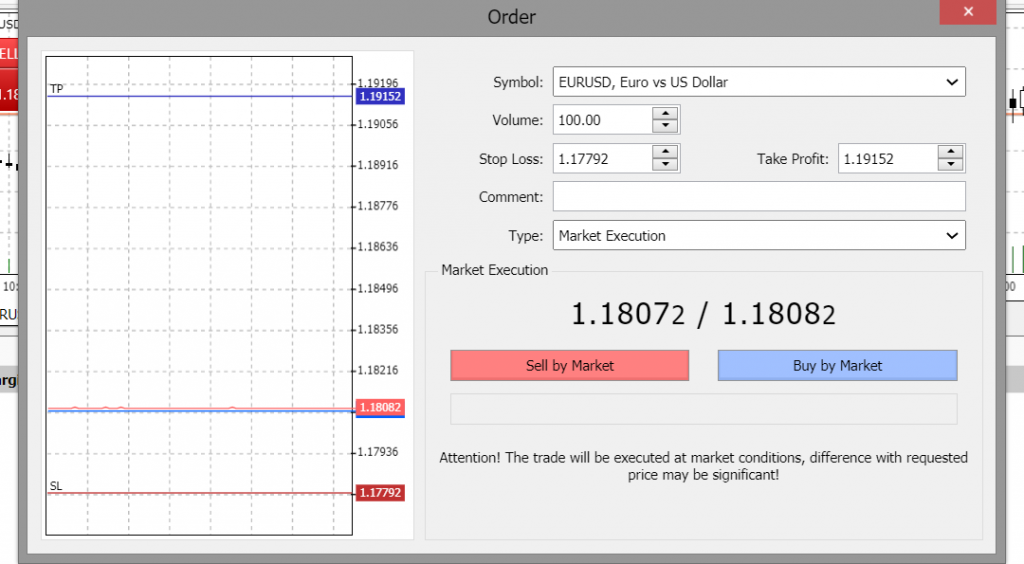

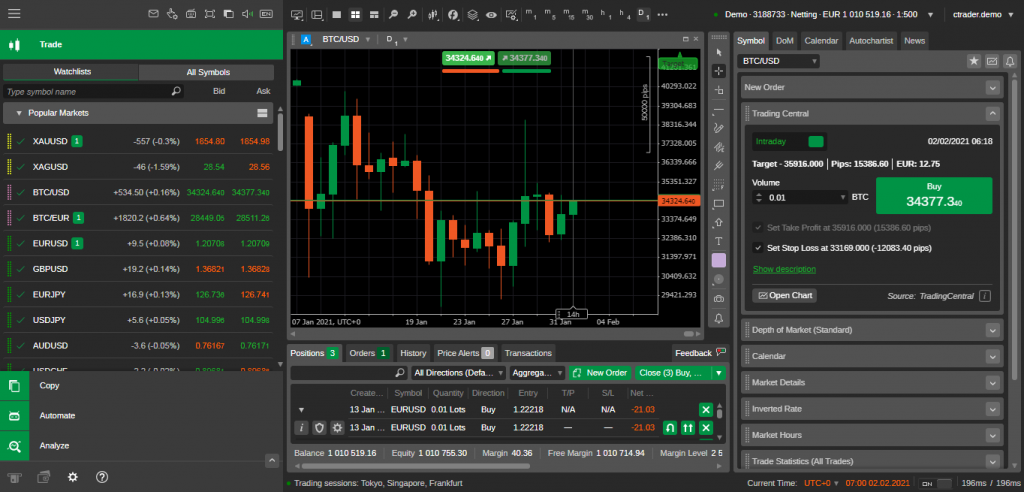

Managing stop loss and take profit levels effectively is crucial for successful forex trading. As market conditions evolve, it may become necessary to adjust these levels to optimize risk management