In forex trading, stop loss orders play a crucial role in managing risk and protecting capital. MetaTrader 5 (MT5) offers traders a variety of stop loss order types to suit different trading strategies and market conditions. In this article, we will explore the different types of stop loss orders available in MT5 and how they can be effectively used in forex trading.

Fixed Stop Loss Orders

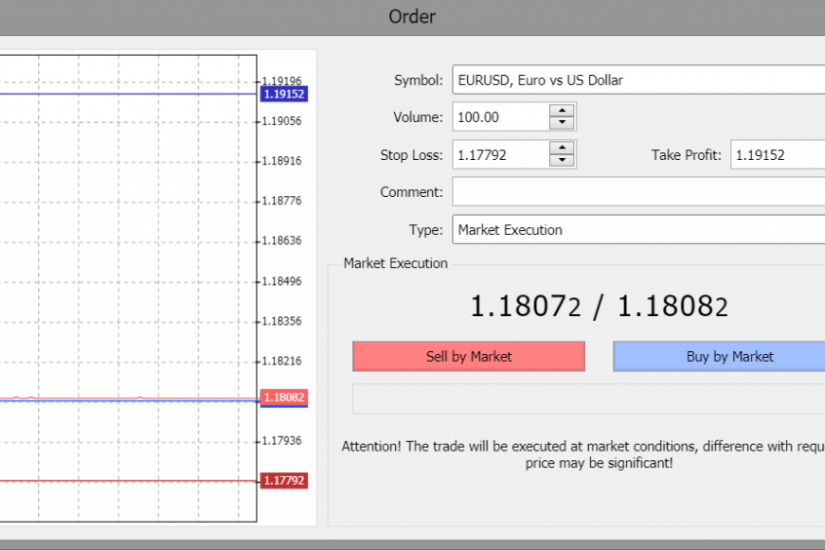

Fixed stop loss orders are the most commonly used type of stop loss in forex trading. With this order type, traders set a specific price level at which they want their position to be automatically closed in case the market moves against them.

In MT5, placing a fixed stop loss order is simple. Traders can modify their trades and enter the desired stop loss level either in pips or as a specific price. This type of stop loss provides a clear and predefined level of risk for each trade.

Trailing Stop Loss Orders

Trailing stop loss orders are dynamic and adjust the stop loss level as the trade moves in favor of the trader. The trailing stop “trails” the market price by a specified distance or percentage, allowing traders to protect their profits while giving the trade room to potentially reach higher levels.

MT5 offers a trailing stop feature that can be easily applied to trades. Traders can set the trailing stop distance or percentage in pips or as a specific price level. As the market price moves in the desired direction, the trailing stop automatically adjusts to lock in profits.

Guaranteed Stop Loss Orders

Guaranteed stop loss orders (GSLO) provide an extra level of protection by guaranteeing the execution of the stop loss level, regardless of market gaps or slippage. GSLOs can be particularly useful during periods of high volatility or when trading news events.

MT5 does not provide built-in GSLO functionality. However, some brokers who offer MT5 as their trading platform may provide GSLOs as an additional service. Traders can check with their broker to determine if GSLOs are available and how to utilize them effectively.

Break Even Stop Loss Orders

Break even stop loss orders are used to protect profits by moving the stop loss level to the trade’s entry price once the trade has reached a certain profit level. This ensures that the trade will, at worst, break even if the market reverses.

While MT5 does not have a specific order type for break even stop loss, traders can manually modify their stop loss levels once the desired profit level is reached. By moving the stop loss to the entry price, traders eliminate the risk of losing capital on the trade.

Time-Based Stop Loss Orders

Time-based stop loss orders are used to close a trade after a specific duration, regardless of the market price. These orders are particularly relevant for traders who want to limit their exposure to overnight or weekend market movements.

MT5 does not have a built-in time-based stop loss order feature. However, traders can set alarms or reminders to manually close their trades after a specific time period. Alternatively, some brokers may offer time-based order functionality through custom plugins or features.

Conclusion

Understanding the different types of stop loss orders available in MT5 is essential for effective risk management in forex trading. Whether using fixed stop loss, trailing stop loss, guaranteed stop loss, break even stop loss, or time-based stop loss, traders can tailor their risk management strategies to their specific trading style and market conditions.

By utilizing the wide range of stop loss order types provided by MT5, traders can protect their capital, lock in profits, and manage risk more efficiently. It is crucial to assess the specific needs of each trade and choose the appropriate stop loss order type accordingly. Successful traders recognize the importance of disciplined