How to Read Candlestick Charts in Forex Trading: In this comprehensive guide, we will delve into the intricacies of interpreting candlestick charts effectively to enhance your Forex trading skills. We will provide seasoned traders with a thorough understanding of what candlestick charts are, their significance in currency trading, the anatomy of candlestick charts, and a detailed breakdown of how to read and analyze them.

Candlestick Charts Unveiled

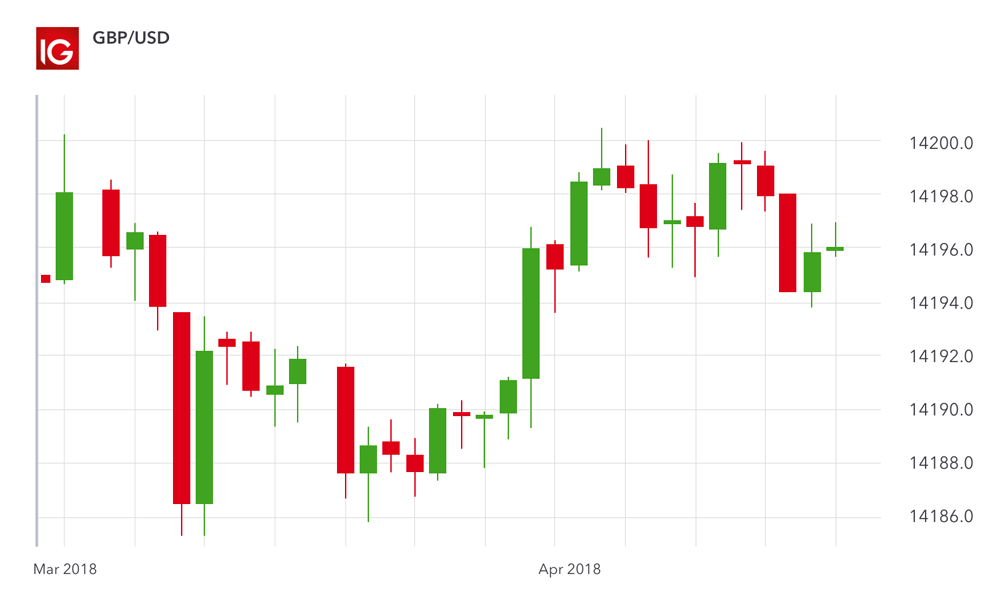

Candlestick charts stand as a powerful tool in the arsenal of Forex traders worldwide. They offer unique insights into price movements for currencies, securities, and derivatives. These charts are versatile, capable of depicting critical information for various time frames, including open, close, high, and low prices. Consequently, candlestick charts play a vital role in the technical analysis of currency price patterns.

To appreciate the essence of candlestick charts, it’s essential to glimpse into their historical roots. Candlestick charting originated in 17th-century Japan, where it was initially employed in the rice trade. While distinct from the later version introduced by Charles Dow in 1900, the core principles remained remarkably similar. In essence, candlestick charts emphasize the primacy of price action over the rationale behind market movements. They encapsulate all available information in the form of price, embodying the role of human emotions such as fear and greed in market dynamics. In essence, candlestick charts encapsulate a wealth of trading wisdom that has evolved over centuries, ultimately shaping the methodology we employ today as Forex traders.

Understanding Candlestick Charts in Currency Trading

As previously mentioned, candlesticks serve as visual representations of price action over specific time intervals. They not only convey market sentiment but also hint at potential market reversals through their distinctive price movement patterns. Understanding this foundational concept is pivotal in mastering the art of using candlestick charts in your trading endeavors.

When analyzing price movements in the Forex market, traders often turn to charts. A common contrast can be made between line charts and candlestick charts. Line charts offer a simplistic depiction of price movement, presenting data as a continuous line comprised of data points. This representation is akin to what you might encounter in newspapers and magazines, illustrating the price trajectories of stocks and shares.

In contrast, candlestick charts offer a more information-rich alternative. Forex traders favor them for their ability to provide in-depth insights into price movements. Unlike line charts, candlestick charts are not composed of a single line but are instead constructed using individual candlesticks, each conveying a wealth of information within its structure.

It’s important to note that candlestick charts can be tailored to different time frames. For example, if set to a 30-minute time frame, each candlestick will encapsulate 30 minutes of price data. Similarly, a 15-minute chart will produce candlesticks representing 15 minutes of trading activity. This versatility allows traders to zoom in on specific time frames and gain a more detailed understanding of price movements.

To illustrate this concept, consider two charts displaying the price action of the EUR/USD currency pair. In the 30-minute chart, you will observe two substantial candles within a shaded region, representing the same time frame as the 12 smaller candles on a 5-minute chart. This underscores the principle that the time frame determines the duration required for each individual candlestick to form.

The Anatomy of Candlestick Charts

Upon closer inspection of a candlestick chart, you’ll notice a rectangular box, known as the body, which represents the most critical aspect of a candlestick. The body indicates the opening and closing prices for a specified time period. For instance, on a one-hour chart, the body of each candlestick will reveal the opening and closing prices for that hour.

Additionally, candlesticks possess wicks at both their upper and lower ends, denoting the highest and lowest prices recorded during the given time interval. Charts that display the open, high, close, and low prices for a specific period are referred to as OHLC (Open, High, Low, Close) Forex charts. The color of the body is indicative of whether the candlestick is bullish (signifying price increases) or bearish (indicating price declines).

Traders can personalize the color scheme of candlesticks to suit their preferences using trading software. Generally, a bullish candlestick has its opening price near the bottom and the closing price near the top, while a bearish candlestick exhibits the opposite pattern.

To apply technical analysis to candlestick patterns, consider this example: if a candlestick is bearish (colored orange), it signifies that the price of a currency pair decreased during the time period it represents. This suggests that there were more sellers than buyers during that period, resulting in a lower closing price compared to the opening price. The wicks indicate the highest and lowest prices observed during the day.

In Conclusion

Candlestick charts are invaluable tools in the world of Forex trading. Their user-friendly structure provides traders with comprehensive insights, making them an indispensable part of daily trading routines. Candlestick charts excel in displaying all the essential price information and market sentiment, facilitating informed trading decisions.

For those looking to deepen their knowledge of candlesticks, we recommend reading our related article: “Everything You Need to Know About Candlestick Trading.”

To excel in candlestick trading, it’s crucial to have access to robust charting capabilities. MetaTrader stands as one of the premier trading platforms, offering top-tier charting options and a fully customizable interface. Tailor your trading experience to your style, and start trading on the world’s leading multi-asset platform by clicking the banner below.

Frequently Asked Questions (FAQs) on Reading Candlestick Charts in Forex Trading

1. What Are Candlestick Charts, and Why Are They Important in Forex Trading?

Candlestick charts are visual representations of price movements in Forex trading. They are crucial because they provide valuable insights into market sentiment, potential reversals, and price action over specific time frames. Traders use candlestick charts to make informed trading decisions.

2. How Do Candlestick Charts Differ from Other Types of Charts?

Candlestick charts differ from other charts, such as line charts, by using individual candlesticks to represent price data. Each candlestick contains information about open, close, high, and low prices for a given period, making them more informative and detailed than other chart types.

3. What Is the History Behind Candlestick Charts?

Candlestick charting originated in 17th-century Japan and was initially used in rice trading. Over time, these charts evolved and were introduced to the Western world by Steve Nison in the 19th century. The core principles of candlestick charting emphasize price action and market emotions.

4. How Can I Determine Market Sentiment Using Candlestick Charts?

Market sentiment can be inferred from the color and shape of candlesticks. Bullish candlesticks (typically green or blue) indicate upward price movements, signaling optimism among buyers. Conversely, bearish candlesticks (usually red or orange) represent downward price trends, indicating more sellers in the market.

5. Can Candlestick Charts Be Used for Different Time Frames?

Yes, candlestick charts are highly adaptable and can be used for various time frames. Whether you’re analyzing hourly, daily, or minute-by-minute data, candlestick charts can accommodate your preferred time frame to provide insights into price movements.

6. What Do Candlestick Bodies and Wicks Represent?

The body of a candlestick represents the opening and closing prices for a specific time period. The wicks or shadows at the top and bottom indicate the highest and lowest prices recorded during that time interval. Together, they encapsulate the price range and price action.

7. How Do I Recognize Candlestick Patterns for Trading Signals?

Candlestick patterns are formed by the arrangement of candlesticks on a chart. Various patterns, such as doji, engulfing, and hammer, can indicate potential reversal or continuation signals. Traders study these patterns to make more accurate predictions.

8. Which Trading Platform Is Best for Analyzing Candlestick Charts?

MetaTrader is a popular trading platform known for its robust charting capabilities. It offers a customizable interface and a wide range of technical analysis tools, making it an excellent choice for traders who want to utilize candlestick charts effectively.

9. Can Candlestick Charts Help Identify Support and Resistance Levels?

Yes, candlestick charts can assist in identifying support and resistance levels. Traders often look for specific candlestick patterns near these levels to make trading decisions, as these patterns can provide insights into potential price reversals or breakouts.

10. Where Can I Learn More About Candlestick Trading?

To further enhance your knowledge of candlestick trading, consider attending trading webinars, reading books on technical analysis, or taking online courses. Many educational resources are available to help traders master the art of candlestick analysis.