Fibonacci retracement is a popular technical analysis tool used by forex traders to identify potential support and resistance levels in the market. These levels can be effectively utilized for determining stop loss and take profit levels, providing traders with a systematic approach to risk management and profit optimization. MetaTrader 5 (MT5) offers robust Fibonacci retracement tools that can be seamlessly integrated into trading strategies. In this article, we will explore how to use Fibonacci retracement for setting stop loss and take profit levels in relation to MT5.

Understanding Fibonacci Retracement

Fibonacci retracement is based on a sequence of numbers known as the Fibonacci sequence, where each number is the sum of the two preceding numbers (e.g., 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on). In forex trading, Fibonacci retracement levels are derived from the ratios between these numbers, primarily 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

These levels are drawn on price charts to identify potential support and resistance areas, indicating where price might reverse or encounter buying/selling pressure. Traders can exploit these levels to determine stop loss and take profit levels in their trades.

Identifying Swing Highs and Swing Lows

To apply Fibonacci retracement, traders need to identify swing highs and swing lows in the price action. A swing high refers to a peak in price where a downward move begins, while a swing low represents a trough where an upward move starts.

In MT5, traders can easily identify swing highs and swing lows by using drawing tools or the Fibonacci retracement tool provided. By connecting the swing high and swing low points, Fibonacci retracement levels are automatically plotted on the chart.

Setting Stop Loss Levels with Fibonacci Retracement

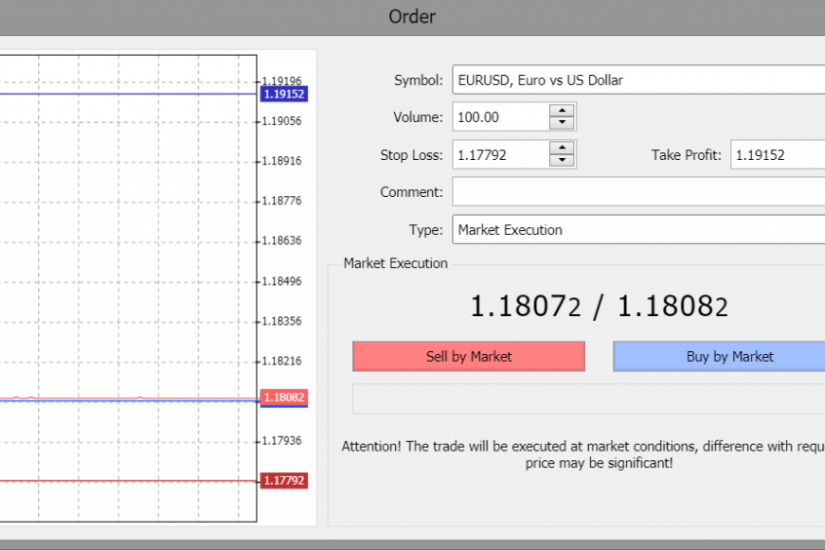

Fibonacci retracement levels can serve as reference points for placing stop loss orders. Traders commonly position their stop loss orders below the Fibonacci retracement levels in an uptrend or above the levels in a downtrend.

For example, if the price is in an uptrend and has retraced to the 50% Fibonacci level, a trader might consider placing their stop loss slightly below this level to protect against potential downward reversals. By using Fibonacci retracement as a guide, traders can set stop loss levels that align with the market’s natural ebb and flow.

Determining Take Profit Levels with Fibonacci Retracement

Fibonacci retracement levels can also assist in determining take profit levels. Traders often aim to secure profits at or near key Fibonacci retracement levels, anticipating potential reversals or significant price reactions.

For instance, if the price is in an uptrend and has reached the 161.8% Fibonacci extension level, a trader might consider setting their take profit level near this level to capture potential exhaustion or resistance. By using Fibonacci retracement as a tool, traders can identify profit targets based on historical price behavior.

Multiple Fibonacci Retracement Levels

In certain situations, multiple Fibonacci retracement levels might overlap, creating a confluence zone. These confluence zones, where different Fibonacci levels cluster together, hold stronger significance and can act as stronger support or resistance areas.

Traders can leverage confluence zones to set tighter stop loss levels or target larger profits. By combining multiple Fibonacci retracement levels, traders gain a more comprehensive view of potential price reactions and enhance their risk management and profit optimization strategies.

Conclusion

Fibonacci retracement is a powerful tool for determining stop loss and take profit levels in forex trading. With MetaTrader 5 (MT5), traders have access to advanced Fibonacci retracement tools that simplify the application of this technique.

By identifying swing highs and swing lows and plotting Fibonacci retracement levels, traders can strategically place stop loss orders below retracement levels in uptrends or above levels in downtrends. Moreover, Fibonacci retracement levels can guide traders in determining take profit targets near key Fibonacci levels, enabling them to capture potential reversals or significant price reactions.

MT5’s comprehensive Fibonacci retracement tools empower traders to make informed decisions and integrate systematic risk management and profit optimization strategies into their trading approach. By incorporating Fibonacci retracement into their analysis, traders can enhance their trading performance and achieve greater consistency in their forex trading endeavors.