Table of Contents

TradingView Review: While not a dedicated trading platform, TradingView offers robust charting capabilities, a wide range of technical indicators, and the ability to share trading ideas with a large community of traders. It can be used in conjunction with a broker’s platform for execution.

Is TradingView Worth It in 2026? A Deep Dive Analysis

For traders and investors, the right tools can make a world of difference. TradingView has been a favorite in the trading community for years, but is it still worth your time and money in 2026? Let’s take a deep dive into its features, pricing, and overall value to help you decide.

What Is TradingView?

TradingView is a web-based charting and analysis platform designed for traders and investors of all levels. Its clean interface, extensive tools, and community-driven features have earned it a solid reputation since its launch in 2011. Whether you trade stocks, forex, cryptocurrencies, or commodities, TradingView offers a versatile platform that caters to diverse needs.

Key Features in 2026

- Advanced Charting Tools TradingView remains the gold standard for charting. In 2026, its charts are more customizable than ever, supporting multi-timeframe views, advanced drawing tools, and hundreds of technical indicators.

- Social Networking for Traders The platform’s community features allow users to share ideas, strategies, and insights. In 2026, TradingView’s social aspect has expanded, integrating AI-driven recommendations and live collaboration tools.

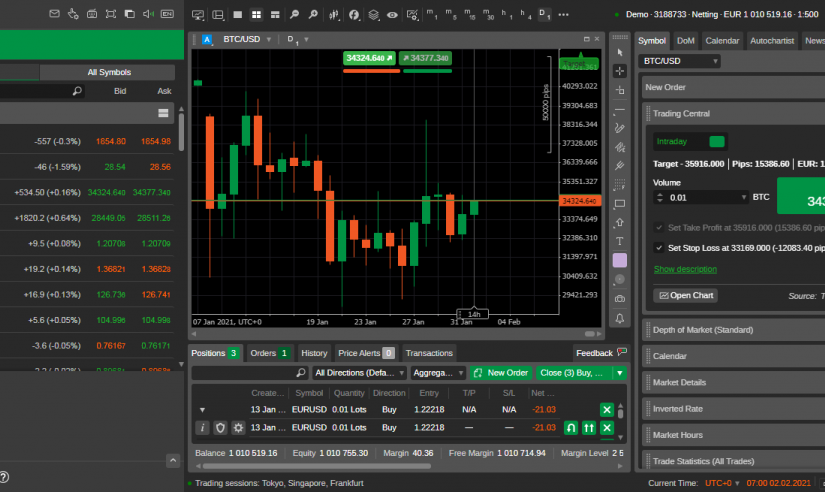

- Integrated Broker Support TradingView now supports direct trading through a growing list of brokers. This seamless integration reduces the need for switching between platforms.

- AI-Powered Insights Leveraging advancements in AI, TradingView offers personalized trading suggestions, sentiment analysis, and automated pattern recognition to help traders stay ahead.

- Multi-Asset Coverage TradingView covers a wide range of markets, including equities, forex, cryptocurrencies, commodities, and ETFs, ensuring traders have access to almost any market they wish to analyze.

Pricing

TradingView offers a tiered subscription model:

- Free Plan: Ideal for beginners, but with limited features such as three indicators per chart and no intraday data.

- Pro ($14.95/month): Unlocks additional features like more indicators and faster data updates.

- Pro+ ($29.95/month): Offers more flexibility with custom timeframes and alerts.

- Premium ($59.95/month): The ultimate plan with priority support, unlimited indicators, and advanced tools.

While the free version is a good starting point, serious traders often opt for Pro or higher to access the platform’s full potential.

Strengths of TradingView

- Ease of Use TradingView’s intuitive interface makes it accessible to beginners while offering depth for advanced traders.

- Community-Driven The vibrant TradingView community is a goldmine for ideas and strategies, making it a valuable resource for traders of all experience levels.

- Cross-Platform Accessibility Whether on desktop, tablet, or mobile, TradingView ensures seamless access and synchronization.

- Frequent Updates TradingView consistently rolls out updates, incorporating user feedback and the latest technological advancements.

Drawbacks to Consider

- Cost for Premium Features While the free plan is robust, accessing TradingView’s full suite of features can get pricey.

- Learning Curve Beginners may feel overwhelmed by the abundance of tools and options.

- Data Limitations on Free Plan Intraday traders might find the free plan’s lack of real-time data a significant limitation.

How Does TradingView Compare to Alternatives?

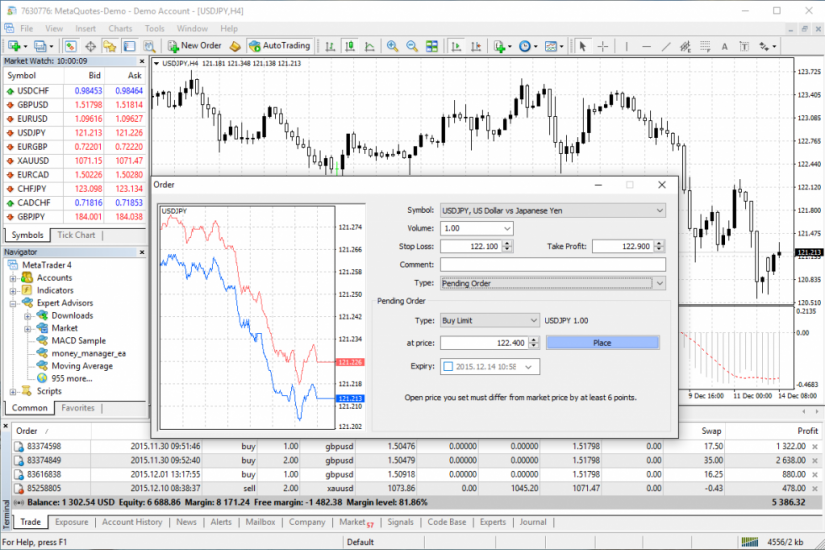

In 2026, TradingView’s competitors, such as MetaTrader, ThinkorSwim, and NinjaTrader, have also evolved. However, TradingView stands out for its:

- User-friendly design

- Extensive community

- Web-based flexibility

While platforms like MetaTrader excel in algorithmic trading, TradingView’s charting and social features make it a standout choice for discretionary traders.

Who Should Use TradingView in 2026?

- Beginner Traders: Start with the free plan to learn and grow.

- Technical Analysts: Utilize advanced charting tools and indicators.

- Community-Oriented Traders: Engage with a global network of like-minded individuals.

- Multi-Market Traders: Access a wide array of markets on one platform.

Final Verdict: Is TradingView Worth It?

In 2026, TradingView continues to shine as a premier charting and analysis platform. Its robust features, dynamic community, and cutting-edge tools justify the investment for serious traders. However, if you’re a casual trader or strictly focused on algorithmic trading, you might find better value elsewhere.

Ultimately, TradingView’s worth depends on your trading style and needs. For those prioritizing technical analysis and collaboration, it remains an indispensable tool in the trading arsenal.

The Pros and Cons of Using TradingView

Pros:

- Extensive Charting Tools: TradingView offers a comprehensive set of charting tools and indicators, allowing traders to perform detailed technical analysis. The platform provides a wide range of drawing tools, multiple timeframes, and various chart types, empowering traders to analyze the markets effectively.

- User-Friendly Interface: TradingView’s interface is intuitive and user-friendly, making it accessible to traders of all experience levels. The platform’s clean design and layout contribute to a smooth user experience, allowing traders to easily navigate between different features and functionalities.

- Social Trading and Community Engagement: TradingView has a large and active community of traders who share ideas, strategies, and analysis on the platform. Traders can follow and interact with other members, gaining insights and learning from their perspectives. This social aspect enhances collaboration and idea generation.

- Versatility and Market Coverage: TradingView supports a wide range of financial markets, including stocks, forex, cryptocurrencies, commodities, and indices. Traders can access multiple markets and instruments from a single platform, streamlining their trading activities.

- Cross-Platform Accessibility: TradingView is a web-based platform that can be accessed from any device with an internet connection, including desktop computers, laptops, tablets, and smartphones. This accessibility allows traders to monitor and manage their positions from anywhere, providing flexibility and convenience.

Cons:

- Advanced Features Limited to Paid Subscriptions: While TradingView offers a free version, access to advanced features and real-time data requires a paid subscription. Some of the more advanced functionalities, such as custom indicators and backtesting, are available only with higher-tier subscription plans.

- Execution Capability: TradingView is primarily a charting and analysis platform and does not directly provide trade execution. Traders need to connect their TradingView account to a supported broker for order placement and execution, which may involve additional setup and potential limitations based on broker integration.

- Learning Curve for Customization: While TradingView offers a high level of customization, modifying and creating custom indicators or strategies may require some coding knowledge using the Pine Script programming language. Traders without programming experience may find it challenging to leverage the full customization potential of the platform.

- Market Data and Exchange Coverage: While TradingView supports a wide range of markets, the availability and coverage of real-time market data and exchanges may vary. Traders should ensure that their preferred instruments and exchanges are supported by TradingView and their selected data subscription plan.