Table of Contents

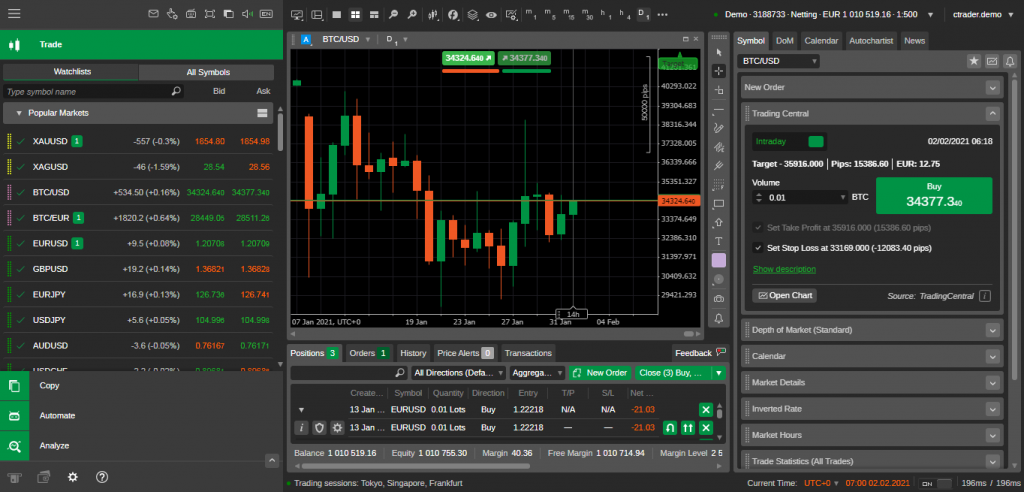

cTrader Review: Known for its intuitive interface and powerful trading features, cTrader offers advanced charting tools, order management capabilities, and customizable trading algorithms.

Is cTrader Worth It in 2026? A Deep Dive Analysis

In the fast-evolving world of forex and CFD trading, selecting the right platform can make or break a trader’s success. Among the many trading platforms available, cTrader has consistently held its ground as a popular choice. But is cTrader still worth using in 2026? This deep dive analysis explores its features, advantages, drawbacks, and whether it stands up to the competition

What is cTrader?

Launched in 2010 by Spotware Systems, cTrader is a trading platform designed to meet the needs of both beginner and advanced traders. Known for its sleek design, user-friendly interface, and robust features, cTrader has garnered a reputation for transparency and reliability. It is primarily used for forex and CFD trading and offers direct market access (DMA), ensuring fair pricing and transparency in execution.

Key Features of cTrader in 2026

As technology continues to reshape trading, cTrader has introduced several updates to keep up with industry demands. Here are the standout features that make it relevant in 2025:

1. Advanced Charting Tools

With over 70 built-in indicators and a wide array of drawing tools, cTrader offers comprehensive charting capabilities. The platform supports multiple timeframes, custom indicators, and automated trading strategies, making it ideal for technical analysis.

2. Algorithmic Trading with cTrader Automate

Formerly known as cAlgo, cTrader Automate allows traders to develop, test, and deploy algorithmic trading strategies. Using C# and .NET, traders can create custom bots to execute trades automatically, a crucial feature for those looking to capitalize on 24/7 market opportunities.

3. Level II Pricing

cTrader’s Level II pricing gives traders deeper insight into market depth, showcasing the full range of executable prices. This feature is particularly beneficial for scalpers and high-frequency traders.

4. Copy Trading with cTrader Copy

For beginners or those looking to diversify their strategies, cTrader Copy is an excellent feature. It enables traders to follow and replicate the strategies of experienced traders, providing an accessible way to learn and potentially profit.

5. Multi-Device Compatibility

cTrader’s seamless integration across desktop, web, and mobile platforms ensures that traders can stay connected and make decisions on the go. Its cloud sync feature ensures that your settings and strategies are always up-to-date, no matter the device.

6. Regulatory Transparency

One of cTrader’s strongest selling points is its commitment to transparency. It’s often used by brokers offering DMA, ensuring no conflicts of interest and fair trading conditions.

Advantages of cTrader

User-Friendly Interface

cTrader’s intuitive design makes it easy for traders to navigate and execute trades. Unlike platforms with steep learning curves, cTrader balances simplicity with functionality.

Customizability

From chart layouts to algorithmic trading scripts, cTrader allows extensive customization, catering to individual trading preferences.

Lightning-Fast Execution

With ultra-low latency and no dealing desk intervention, cTrader ensures quick and accurate trade execution, critical for active traders.

Support for Multiple Account Types

cTrader supports a variety of account types, including demo accounts, making it accessible to traders at all levels.

Drawbacks of cTrader

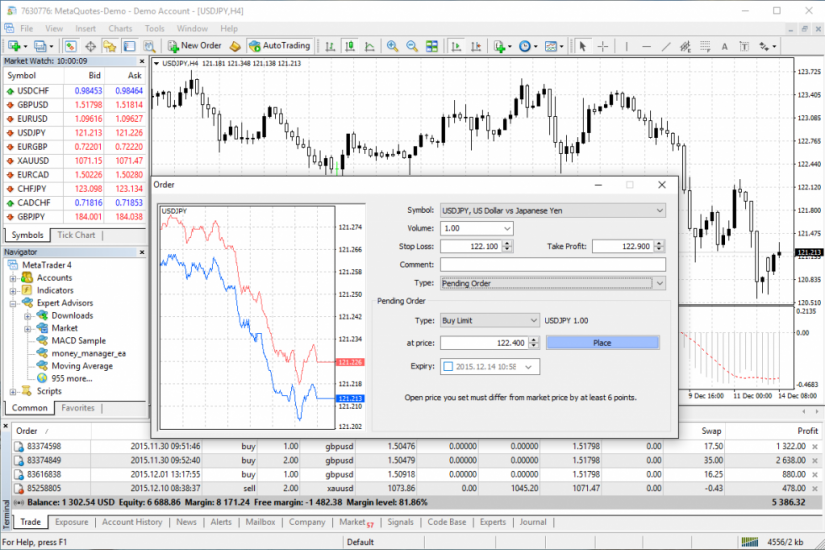

Limited Broker Support

While cTrader is offered by a growing number of brokers, it still lags behind MetaTrader in terms of widespread adoption. This limited availability can be a dealbreaker for traders tied to specific brokers.

Steeper Learning Curve for Algorithmic Trading

While cTrader Automate is powerful, it requires knowledge of programming in C#. This may be intimidating for traders without a technical background.

Fewer Add-Ons Compared to MetaTrader

MetaTrader’s marketplace for third-party tools and indicators is unmatched. While cTrader’s ecosystem is growing, it’s not yet as extensive.

How Does cTrader Compare to Competitors?

cTrader vs. MetaTrader 4/5

MetaTrader remains the most widely used platform, boasting a massive library of tools and indicators. However, cTrader’s modern interface, transparency, and superior charting tools give it an edge for many traders.

cTrader vs. NinjaTrader

While NinjaTrader is popular among futures traders, cTrader’s focus on forex and CFDs makes it a better choice for those markets. cTrader’s copy trading and mobile compatibility also give it broader appeal.

Is cTrader Worth It in 2026?

The answer largely depends on your trading style and needs. Here are some scenarios where cTrader excels:

- For Technical Traders: Its advanced charting tools and customizable interface are unmatched.

- For Algorithmic Traders: If you’re comfortable with C#, cTrader Automate offers a robust platform for developing and deploying strategies.

- For Transparency Seekers: cTrader’s DMA model and regulatory compliance ensure a fair trading environment.

However, if you rely heavily on third-party tools or have limited broker options, you might face some limitations with cTrader.

The Pros and Cons of Using cTrader Platform

Pros:

- Intuitive and User-Friendly Interface: cTrader is recognized for its sleek and intuitive interface, making it easy to navigate for both beginner and experienced traders. The platform’s clean design and customizable layout allow users to personalize their trading environment according to their preferences.

- Advanced Charting and Technical Analysis: cTrader offers a wide range of charting tools, including multiple timeframes, a variety of drawing tools, and a comprehensive selection of technical indicators. Traders can conduct in-depth analysis and make informed trading decisions with the platform’s advanced charting capabilities.

- Depth of Market (DOM) and Level II Pricing: cTrader provides access to Depth of Market (DOM) information, allowing traders to view the order book and market liquidity levels. This feature provides transparency and assists traders in making more informed trading decisions. Additionally, cTrader supports Level II pricing, which displays the bid and ask prices from liquidity providers, providing a more comprehensive view of the market.

- Algorithmic Trading Capabilities: cTrader supports automated trading through its cAlgo feature. Traders can develop and deploy their own custom trading algorithms using the C# programming language. The platform also offers a vast library of pre-built cBots (automated trading strategies) that can be utilized or modified as per individual preferences.

- Trade Copying and Social Trading: cTrader offers a trade copying feature, enabling traders to automatically replicate trades from other successful traders in the platform’s community. This functionality is beneficial for beginner traders who can learn from experienced traders and potentially generate profits by following their strategies.

Cons:

- Limited Availability: While cTrader is widely used, it may not be as readily available as some other trading platforms. It is primarily offered by specific brokers, and traders may need to choose a broker that supports the cTrader platform to access its features.

- Custom Indicator Availability: Compared to more established platforms like MetaTrader, cTrader may have a smaller library of custom indicators and technical tools available. However, traders can still utilize the platform’s extensive built-in indicators and drawing tools for their analysis.

- Learning Curve for Advanced Features: While the platform is user-friendly, some of the more advanced features and customization options, such as creating custom indicators or cBots, may require a learning curve and familiarity with the C# programming language.

In conclusion, cTrader is a user-friendly trading platform that offers advanced charting tools, depth of market information, algorithmic trading capabilities, and social trading features. Despite its limited availability and learning curve for advanced customization, cTrader provides a reliable and efficient platform for traders to analyze markets and execute trades.

Conclusion

cTrader remains a formidable trading platform in 2026, blending advanced technology, transparency, and user-friendly design. While it may not have the widespread adoption of MetaTrader, its features cater to a niche audience that values precision and customization. Whether you’re a seasoned trader or a beginner exploring the markets, cTrader deserves serious consideration as a tool to enhance your trading journey.