Understanding How Forex Trading Works: For many newcomers to the world of trading, the intricacies of Forex trading can seem daunting and mysterious. They often grapple with fundamental questions about whether Forex trading even works. However, these questions may not be the right approach to understanding the essence of Forex trading. In this comprehensive guide, we will unravel the complexities of Forex trading step by step, demystifying how it operates and what you need to know to be successful in this dynamic market.

The Basics of Forex Trading

Supply and Demand: The Foundation

In economics, the principles of supply and demand play a pivotal role in price determination within a competitive marketplace. The price of a commodity or asset is determined at the equilibrium point where the quantity demanded equals the quantity supplied.

To illustrate this concept, let’s consider a simple scenario. Imagine you are shopping for apples, and there is only one vendor offering the exact quantity of apples you need. You negotiate a price, and the exchange takes place – money in exchange for apples, a straightforward trade where both parties get what they want.

Now, suppose the next day, you return to buy the same amount of apples, but this time there are two vendors, each offering the desired quantity. This increase in supply compared to demand will lead to competition between vendors, pushing the price of apples lower. Eventually, a new price will be established, and you will make your purchase from the vendor with the more attractive price.

On the contrary, if you had brought a friend who also wanted apples but only one vendor was available, the demand for apples would exceed the supply, leading the vendor to increase the price, knowing that both you and your friend are willing to buy all their apples.

This fundamental economic concept is crucial for aspiring traders to grasp, as it forms the basis for understanding how the Forex market operates.

Applying Supply and Demand to Forex

Now, let’s apply the same supply and demand logic to the foreign exchange market (Forex). In Forex, every time a specific currency is purchased, it creates excess demand in the market, causing the price to rise. Conversely, when a currency is sold, it leads to excess supply, pushing the price lower.

The impact of these transactions is directly proportional to the trading volume involved. Major players like national banks can significantly disrupt the market by manipulating the supply of their domestic currency. While retail traders have a more limited influence due to their smaller trade sizes, they can still affect the market collectively.

The constant ebb and flow of supply and demand for currencies are the driving forces behind Forex charts. Understanding this principle is essential for comprehending how online Forex trading operates, as all economic events worldwide are relevant to the market only in terms of their impact on supply and demand. It is also crucial to consider how these events influence the projected supply and demand of an asset.

For instance, in our apple market analogy, if one of the apple vendors goes bankrupt, you and your friend can expect the price of apples to rise even before you arrive at the market.

Navigating the Forex Industry

A Map of the Industry

To grasp how the Forex market functions, envision it as an ever-changing ocean with various participants, each varying in size based on their financial capacity. There are colossal entities such as national banks, multinational corporations, and hedge funds. Their monetary policies and trading decisions have the most substantial impact on market dynamics, causing significant price fluctuations.

Mid-sized players include private investors, companies in need of hedging services, and private banks. These participants usually have direct access to the Forex interbank market, where currency exchanges occur without intermediaries, thanks to their substantial funds.

On the other end of the spectrum are the smaller players, including retail Forex traders – individuals like you aiming to enter the market. Retail traders often require the services of Forex brokers or banks to access the market through trading servers. Understanding your position in this hierarchy is crucial to exercising the caution necessary for successful trading.

The Forex Market and Central Banks

In Forex, currencies are not just tradable assets; they also function as economic tools and indicators. Currencies can be thought of as stocks if countries were treated as companies. Central banks wield significant influence over currency prices through their management of money supply, making their monetary policy decisions pivotal factors in Forex trading.

For example, the interest rates set by a country’s central bank can have a profound impact. When interest rates rise, borrowing that currency becomes more expensive, leading to a shortage in currency supply and an increase in its price. While this may initially seem positive, it can hinder economic growth in the short term.

Conversely, lowering interest rates encourages borrowing, increases currency supply, and leads to currency devaluation. This may spur short-term economic growth but can also lead to excessive debt accumulation and potential financial crises in the long run.

Understanding the interplay between central bank policies and currency values is crucial for comprehending how the Forex market operates.

Analysis: The Key to Forex Trading Success

The Role of Analysis

Analysis is not just a component of successful Forex trading; it is the very essence of it. There are two primary schools of market analysis: fundamental and technical.

Fundamental Analysis

Fundamental analysis is akin to financial detective work on a national or global scale. It involves examining various aspects of an economy, such as its current stage in the economic cycle, significant events, future forecasts, and their potential impact on the market.

Fundamental analysis considers factors like GDP, unemployment rates, interest rates, export levels, geopolitical events, elections, natural disasters, and economic advancements. These factors are evaluated in terms of their influence on supply and demand. While fundamental analysis requires a deep understanding of international economics, it is suitable for long-term investors.

The drawback of fundamental analysis is the inherent uncertainty due to the multitude of variables. However, when conducted effectively, it can forecast long-term price movements that are advantageous for traders.

Technical Analysis

Technical analysis, on the other hand, focuses solely on two quantifiable variables: time and price. It deals with historical price data and aims to identify patterns and trends. Technical analysts use tools like support and resistance lines, technical indicators, candlestick formations, and more to make trading decisions.

Technical analysis can be applied to both short-term and long-term trading. It is especially favored by traders who thrive on the daily volatility of Forex markets.

The strength of technical analysis lies in its reliance on quantifiable data that is already reflected in the market. However, it assumes that past price patterns can influence future price movements, a concept that may seem implausible to fundamentalists.

In essence, fundamental analysis serves as an economic detective, while technical analysis involves analyzing historical price-time data.

The Importance of Preparation

Fortune Favours the Prepared

One of the primary reasons aspiring traders fail is a lack of preparation. Many newcomers are enticed into Forex trading with promises of quick riches, often viewing it as a form of pseudo-scientific gambling. These individuals often jump into the market without adequate training or a well-thought-out strategy.

To avoid disappointment and losses, it is crucial to prepare adequately for Forex trading. One of the best ways to do this is by utilizing a demo trading account. This risk-free environment allows you to practice trading in real-time conditions, gaining valuable experience before venturing into live markets.

The Mechanics of Forex Trading

Understanding the Basics

In Forex trading, the value of one currency is measured against another currency. This is expressed through a price quote, which consists of two prices: the bid price (used when selling) and the ask price (used when buying). Notably, the ask price is always higher than the bid price, resulting in a spread.

Traders receive these bid and ask prices from their brokerage firms, which, in turn, obtain them from liquidity providers, such as banks. Trading occurs through a Forex trading platform, where traders can place buy or sell orders.

When placing a buy order, for example, on the EUR/USD currency pair, a portion of your account funds is used to purchase the base currency (Euro) while selling the quoted currency (US Dollar). This process can take place either with the broker (Market Maker) or directly in the Forex interbank market (ECN execution), depending on the broker’s setup.

Forex Trading in the Modern Age

Forex Trading Apps

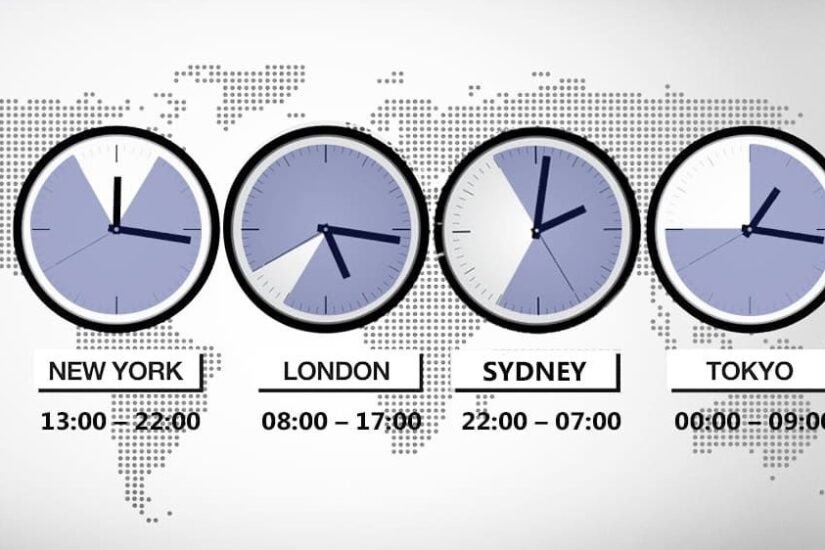

Today, technological advancements have made Forex trading accessible 24/7 through trading apps and web platforms. These apps allow traders to open accounts with reputable brokers, download trading platforms, and execute trades easily.

MetaTrader 5 is widely regarded as one of the best platforms for Forex trading. It is available on desktop, web terminals, and as a mobile app, making it a versatile tool for traders. Additionally, the MetaTrader 5 Supreme Edition (MT5SE) offers over 60 additional features that enhance the trading experience.

Leveraging Opportunities and Signals

Using Leverage in Forex Trading

Leverage is a crucial concept in Forex trading, allowing traders to control larger positions than their initial capital. It can amplify both profits and losses, making it a double-edged sword. Careful risk management is essential when using leverage.

Trading Signals in Forex

Trading signals are recommendations for entering or exiting trades. They can be generated by trading algorithms or human analysts. These signals often specify a currency pair, entry price, stop loss level, target price, and the direction (buy or sell). Traders can receive signals via email, text, or messaging apps, and some providers even offer automated copying of trades.

Starting with Limited Capital

How to Start Trading with $100

Despite the perception that trading requires substantial capital, it is possible to start with as little as $100. With a well-defined trading strategy and effective risk management, small accounts can grow over time.

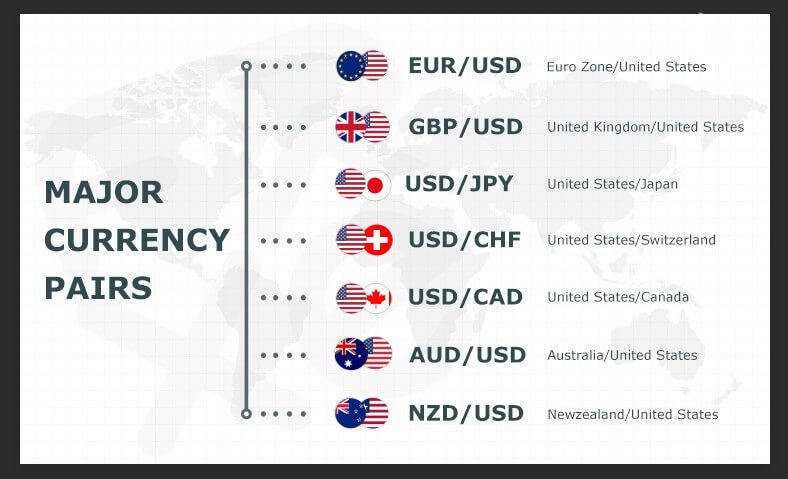

Beginners are advised to focus on a single currency pair, such as EUR/USD, due to its high liquidity and tight spreads. As traders gain experience and their accounts grow, they can gradually diversify into other currency pairs.

In conclusion, understanding how Forex trading works is a gradual process that requires a solid grasp of supply and demand dynamics, an awareness of the industry’s key players, and proficiency in both fundamental and technical analysis. While technology has made Forex trading more accessible, the importance of preparation, sound risk management, and continuous learning cannot be overstated. Whether you start with $100 or more, success in Forex trading hinges on discipline, strategy, and a deep understanding of market dynamics.

Frequently Asked Questions (FAQs)

- What is Forex trading, and how does it work? Forex trading, also known as foreign exchange trading, involves the exchange of one currency for another with the aim of profiting from changes in currency values. It operates on the principles of supply and demand, where the price of a currency is determined by the balance between the quantities demanded and supplied in the market. Traders speculate on whether a currency will appreciate or depreciate relative to another currency, and they buy or sell accordingly.

- How does supply and demand affect Forex trading? Supply and demand are fundamental concepts in Forex trading. When demand for a currency exceeds its supply, its price tends to rise, and when supply exceeds demand, the price falls. Traders analyze economic events and data to anticipate shifts in supply and demand, which influence currency prices.

- What are the key players in the Forex market? The Forex market consists of various participants, ranging from central banks and multinational corporations to retail traders. Central banks play a significant role in shaping currency values through their monetary policies. Multinational corporations engage in Forex to hedge against currency risks. Retail traders are individual traders who participate through brokers.

- What is the difference between fundamental and technical analysis in Forex trading? Fundamental analysis involves evaluating economic and geopolitical factors to predict currency price movements. It considers indicators like GDP, interest rates, and political events. Technical analysis, on the other hand, relies on historical price data and patterns to forecast future price movements. It involves chart analysis and the use of technical indicators.

- How can I prepare for Forex trading? Preparation is vital for success in Forex trading. Start by educating yourself about the market, trading strategies, and risk management. Open a demo trading account to practice without risking real money. Develop a trading plan and stick to it, and be prepared to continuously learn and adapt to changing market conditions.

- What is leverage in Forex trading, and how should it be used? Leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases the potential for losses. It should be used cautiously and in conjunction with proper risk management strategies. It’s crucial to understand the risks associated with leverage before using it in trading.

- What are Forex trading signals, and how can I use them? Forex trading signals are recommendations provided by trading algorithms or human analysts. They suggest entry and exit points for trades, along with stop-loss and take-profit levels. Traders can use these signals to inform their trading decisions or even automate their trades. However, it’s essential to research signal providers and verify their credibility.

- Can I start Forex trading with a small amount of capital, like $100? Yes, you can start Forex trading with a relatively small amount of capital, such as $100. However, it’s essential to practice sound risk management and consider starting with a demo account to gain experience. As your trading skills improve and your account grows, you can gradually increase the size of your trades.

- Which currency pairs are suitable for beginners in Forex trading? For beginners, it’s advisable to focus on major currency pairs, such as EUR/USD, GBP/USD, or USD/JPY. These pairs offer high liquidity and tighter spreads, making them more accessible and less volatile for inexperienced traders. As you gain confidence and experience, you can explore other currency pairs.

- Is Forex trading the same in different regions, like the UK? Forex trading operates similarly across regions, but there may be varying regulations and broker-specific differences. It’s essential to choose a reputable broker that complies with the regulations in your region. Additionally, some regions may have specific tax implications for Forex trading, so it’s wise to consult with a financial advisor for guidance.