- How To Trade Forex?

- 6mins read

- 146 Views

Table of Contents

TogglePerfect Forex Trading Hours and Trading Sessions: The Forex market, with its staggering daily trading volume exceeding $6 trillion, stands as the world’s largest financial marketplace. Success in this dynamic realm hinges on a deep understanding of various factors, one of which is the Forex trading hours and the influence of distinct trading sessions. In this comprehensive guide, we will delve into the intricacies of Forex market hours, dissect the major Forex trading sessions, identify optimal trading times, and offer valuable insights for traders.

Understanding Forex Market Hours and Trading Sessions

The Forex Market Hours

The Forex market operates around the clock, five days a week, encompassing a diverse mix of participants, including central banks, hedge funds, investment management firms, retail Forex brokers, and individual investors from across the globe. Unlike traditional markets, the Forex market is not centered around a single exchange. Instead, it comprises a worldwide network of exchanges and brokers, with trading hours dictated by the active trading sessions in participating countries. To optimize your trading strategy, it’s crucial to grasp the nuances of Forex trading hours and the impact of different trading sessions.

The Four Major Forex Trading Sessions

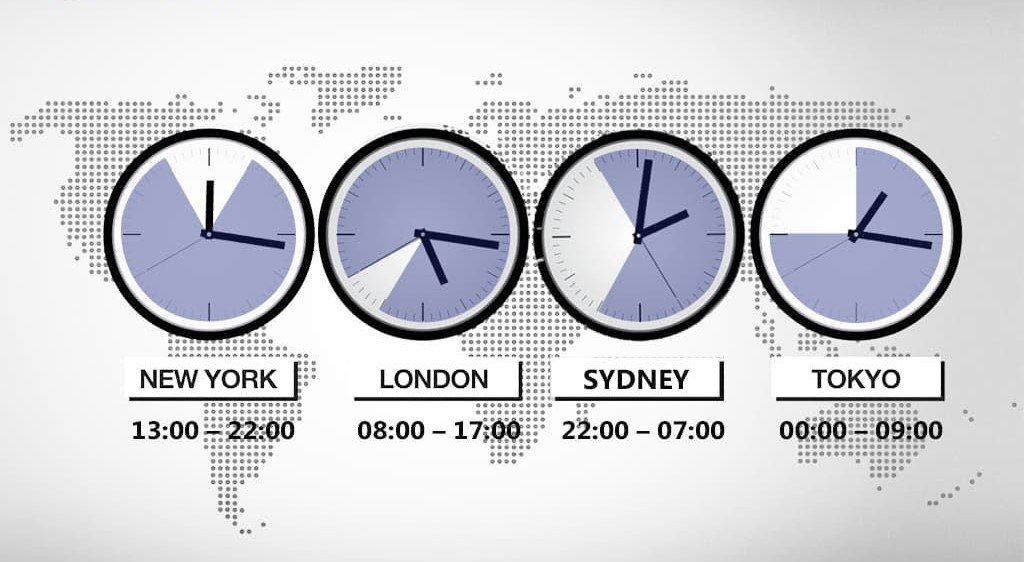

The Forex trading day is divided into four primary sessions, each named after the major financial hub in its respective region. Understanding these sessions is key to determining the best times to trade Forex. Here are the four major Forex trading sessions:

- Sydney Session: The trading day commences in New Zealand, but the Sydney market lends its name to the first Forex session. As one major Forex market nears its closing time, another opens, creating a seamless transition of trading activity throughout the day.

- Tokyo Session: Following the weekend break for Europeans, the Asian trading session kicks off on Sunday evening (European time). While this session is often associated with Tokyo, it includes significant participation from other locations such as Australia, China, and Singapore. Liquidity during the Tokyo session can be lower compared to the London and New York sessions.

- London Session: The European session takes over as the Asian session winds down. London’s time zone is pivotal as it is not only the hub of European Forex trading but also a global leader. The London session overlaps with the Tokyo and New York sessions, resulting in increased liquidity and potentially narrower spreads. It is also known for its higher volatility, with a dip in activity during the mid-session.

- New York Session: As the North American session starts, the Asian markets have already closed, while the European trading day is still ongoing. The US, along with contributions from Canada, Mexico, and select South American countries, drives the New York session’s activity. Morning hours typically feature high liquidity and volatility, which tends to taper off in the afternoon.

Overlaps in the Forex Sessions

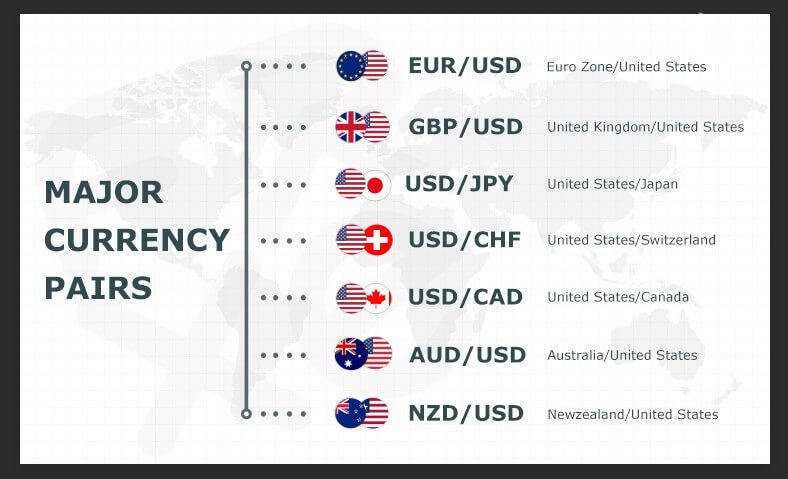

Notably, there are periods during the trading day when two sessions overlap, leading to increased Forex market activity due to a higher number of active participants. These overlaps, characterized by greater volatility and liquidity, are the busiest times for Forex transactions. Different currency pairs exhibit varying levels of activity during the day, depending on the active market participants. For instance, during the overlap between the London and New York sessions, EURUSD and GBPUSD tend to be most active, with higher volatility and liquidity. In contrast, these pairs may experience lower volatility and liquidity during the Sydney session. Understanding these patterns empowers traders to align their strategies with the most opportune Forex trading times, whether seeking high volatility or preferring more stable conditions.

The Best Time to Trade Forex and the Worst

Determining the best and worst times to trade Forex is subjective and contingent upon individual trading strategies, styles, and preferred currency pairs. For traders seeking heightened volatility, market overlaps present prime opportunities, while those averse to extreme market conditions should exercise caution during these times. Moreover, traders should be vigilant in the lead-up to and aftermath of crucial economic announcements, such as interest rate decisions or inflation data releases, which can trigger spikes in market volatility. Conversely, periods of low liquidity should be avoided, notably at the close of the New York session and the commencement of the Sydney session, as traders from different time zones enter or exit the market. Both the beginning and end of the trading week tend to exhibit reduced activity as traders transition in and out of positions, either returning from a break or preparing for the weekend. In conclusion, a comprehensive understanding of Forex market hours and trading sessions is a potent advantage for traders of all levels and styles. By aligning your strategy with the most opportune trading times, you can enhance your prospects for success in the dynamic world of Forex trading.

Forex Trading Hours – FAQ

Here are some frequently asked questions about Forex trading hours and trading sessions, along with concise answers to help you navigate the Forex market effectively.

1. What are the main Forex trading sessions, and why do they matter? Main Forex trading sessions include Sydney, Tokyo, London, and New York. These sessions are named after major financial hubs and impact market activity. Understanding their timings and characteristics is vital for selecting the best times to trade Forex and optimizing your trading strategy.

2. Is the Forex market open 24 hours a day, seven days a week? The Forex market operates 24 hours a day, five days a week. It remains closed during the weekends. This continuous operation allows traders to participate at various times, depending on their preferences and strategies.

3. How do daylight saving time changes affect Forex trading hours? Daylight saving time (DST) can affect the opening and closing times of Forex sessions. While some regions, like Japan, do not observe DST and maintain consistent trading hours, others may shift their session timings in accordance with DST changes, leading to variations in Forex market hours.

4. What are the busiest and most volatile Forex trading sessions? The busiest and most volatile sessions typically occur during the overlaps between major sessions. The London-New York overlap, in particular, tends to be the busiest, featuring high liquidity and volatility. However, it’s essential to choose trading times that align with your risk tolerance and strategy.

5. How can I identify the best time to trade specific currency pairs? To determine the best time to trade specific currency pairs, analyze when their respective base and quote countries are most active. For instance, if you’re trading EURUSD, focus on the London and New York sessions when both the Eurozone and the United States are active.

6. Are there times when I should avoid trading Forex? Yes, there are times to avoid trading. Periods of low liquidity, such as the end of the New York session and the beginning of the Sydney session, are less favorable for trading. Additionally, be cautious during major economic announcements, as they can lead to unpredictable price movements.

7. Can I trade Forex outside of the major trading sessions? You can trade Forex outside of the major trading sessions, but it’s essential to consider the potential drawbacks, such as lower liquidity and wider spreads. To mitigate these risks, adapt your strategy to suit the specific characteristics of off-peak hours.

8. How do I adjust my trading strategy based on Forex trading sessions? Adapting your trading strategy based on trading sessions involves aligning your approach with the level of volatility and liquidity characteristic of each session. For example, you might employ different risk management techniques during the high-volatility London session compared to the quieter Sydney session.

9. Are there Forex market hours that are ideal for beginners? For beginners, trading during the major session overlaps, when liquidity is higher and market conditions are more stable, can be advantageous. These periods provide an opportunity to learn and practice trading with reduced risk compared to off-peak hours.

10. How can I stay updated on Forex market hours and session timings? To stay informed about Forex market hours and session timings, you can utilize trading platforms, economic calendars, or Forex news websites. Many trading platforms also provide real-time session indicators to help you track active sessions.

These FAQs offer valuable insights into navigating the world of Forex trading hours and sessions. By understanding the nuances of market timing, you can make informed decisions and enhance your trading experience.