Understanding the Key Currency Pairs in Forex Trading: In the realm of Forex trading, understanding the fundamentals is paramount for successful progress, and this holds true when it comes to major currency pairs. When embarking on your journey into online Forex trading, grasping the concept of currency pairs, particularly the major ones, is a pivotal starting point. Fortunately, the core principles of currency pairs apply universally, from the most commonly traded to the more exotic FX pairs.

Understanding Currency Pairs

Before delving into identifying the major Forex pairs, let’s first establish what a currency pair entails. In financial trading, the quest for profit often hinges on speculating about the fluctuating value of an asset, whether it be a company’s stock or the worth of a commodity.

Forex trading adds a unique twist to this concept. Here, you speculate on the relative value of one currency in comparison to another. When two currencies are grouped and evaluated against each other, they form a currency pair.

The expression of this relative value is as straightforward as determining how many units of the first currency are equivalent to the second currency. For instance, if we’re examining the exchange rate between the US dollar and the Japanese Yen and it stands at 113.00, it signifies that one US dollar is valued at 113.00 yen. It truly is that uncomplicated. One effective method to commence your journey in trading currencies and gain a preliminary understanding is by experimenting with a demo account.

This approach ensures you don’t jeopardize your capital as you engage in risk-free trading with virtual funds, permitting you to transition to a live account when you feel sufficiently prepared.

Reading Currency Pairs

To illustrate how to read currency pairs, consider this example:

When you observe live Forex prices on platforms like MT4 or MT5, you’ll encounter a wide array of Forex currency pairs. Each currency boasts a three-letter ISO (International Organization for Standardization) symbol, making them relatively easy to identify:

- GBP stands for the British Pound.

- USD signifies the US Dollar.

- JPY represents the Japanese Yen.

- CHF corresponds to the Swiss Franc.

Imagine you anticipate a weakening of the Euro due to low Euro inflation and the likelihood of more lenient monetary policies from the European Central Bank (ECB). In the list of currency pairs, you’ll find the Euro quoted against both the US dollar and the British pound. The beauty of Forex trading lies in the ability to choose which currency you believe the Euro will depreciate against most.

Suppose you believe the US dollar has a strong chance of strengthening against the Euro. This hypothesis could be based on the belief that the Federal Reserve is inclined to tighten its monetary policies while the ECB leans toward a looser stance.

In this scenario, your target currency pair would be the Euro versus the US Dollar (EURUSD). Alongside the symbols for currency pairs, you’ll find exchange rates at which you can execute trades. The bid denotes the rate at which you can sell a currency pair, while the ask represents the rate at which you can purchase. These are also referred to as the ‘bid’ and ‘offer’ or ‘sell’ and ‘buy’ prices. The gap between these two prices is known as the market spread.

If you anticipate the Euro’s weakening and the US Dollar’s strengthening, your objective would likely involve selling the Euro and buying the US dollar. Remember that a currency pair indicates the value of one currency concerning another. Thus, the price quoted for the currency pair signifies the number of US dollars per Euro. If your prediction is correct and the Euro weakens, one Euro will be worth fewer US dollars, leading to a lower exchange rate. Therefore, you’d sell EUR/USD with the hope of a rate decrease, and the rate at which you transact would be the bid price of 1.1036.

When selling the first-listed currency, you always execute at the ‘bid’ price, while buying the first currency necessitates using the ‘ask’ price. To delve deeper into Forex price quotes, explore our dedicated article on the topic: “Understanding and Reading Forex Quotes.”

In summary, you sell when anticipating a decrease in the exchange rate and buy when expecting an increase. Notably, you may have noticed that in the list of currency pairs, the Euro appears first when paired with the US dollar but second when paired with the British pound. In theory, either currency can take the lead (with the rate adjusting if the order is reversed), but practical conventions generally determine the order in which currency pairs are presented.

Typically, the US dollar assumes the lead position in a pair, except when paired with the Euro or the British pound.

Trading with a Demo Account

Traders can also engage in risk-free trading with a demo trading account. This approach allows traders to safeguard their capital and transition to live markets at their discretion. For example, Exness and XMs’ demo trading account grants access to real-time market data, virtual currency for trading, and insights from expert traders.

To open your free demo trading account, click on the banner below:

Liquidity in Trading Major Forex Currency Pairs

The Forex market stands as the world’s most liquid market, yet only a handful of currencies dominate the landscape.

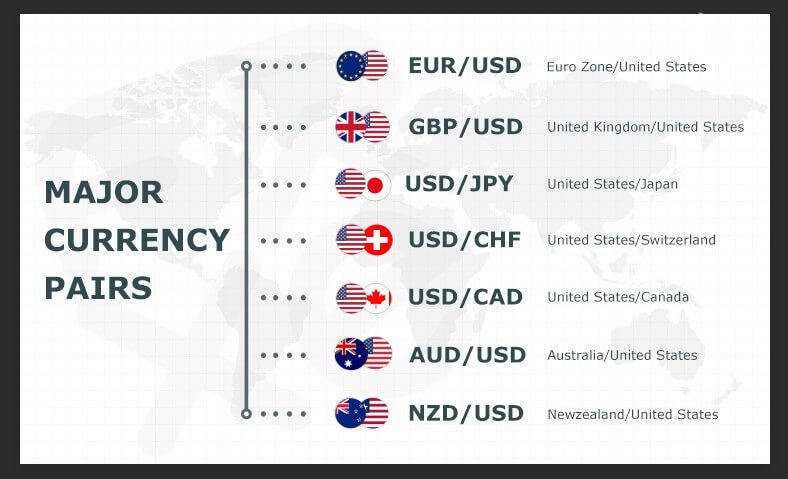

When discussing liquidity, it’s essential to remember that the more significant the trade value between two countries, the more liquid the currency pair involving these nations tends to be. EUR/USD reigns as the most liquid currency pair in the Forex market, and the major currency pairs, often referred to as the majors, capture the spotlight. Although no official list outlines the major currency pairs or designates the best ones, the majors typically encompass the six most actively traded Forex pairs:

- AUD/USD (Australian dollar vs. US dollar)

- EUR/USD (Euro vs. US dollar)

- GBP/USD (British pound vs. US dollar)

- USD/CAD (US dollar vs. Canadian dollar)

- USD/CHF (US dollar vs. Swiss franc)

- USD/JPY (US dollar vs. Japanese yen)

Unsurprisingly, these Forex major pairs feature currencies from the world’s largest economies. The substantial volume of trade in goods and services between these nations plays a significant role in the extensive trading of their currencies. Additionally, their historical economic and political stability enhances their attractiveness, especially during periods of economic uncertainty.

The US dollar (USD) stands out as particularly popular, supported by its status as the preferred reserve currency for central banks worldwide and the pricing of numerous key commodities in US dollars. This necessitates the use of the currency for such transactions. After the US dollar, the Euro ranks as the second most widely held currency, both by institutions and governments.

Pros and Cons of Trading Major Currency Pairs

Trading all currency pairs entails a mix of advantages and disadvantages, but the major currency pairs carry distinct benefits due to their popularity. These pairs tend to receive more extensive news coverage, and their underlying economies regularly provide economic updates that traders closely monitor, offering opportunities for anticipated price fluctuations.

However, this advantage comes at a cost, as successful Forex trading demands constant vigilance, thorough research, and diligent tracking of news developments, economic releases, forecasts, and other relevant data. Traders must stay attuned to these crucial factors while simultaneously monitoring price shifts within their chosen currency pairs.

It’s evident that one significant drawback of Forex trading is the substantial attention and extensive research it necessitates, with no guaranteed high returns as a result.

For instance, the monthly US employment situation report from the US Bureau of Labor Statistics is a critical economic release on the financial calendar. Strong payroll growth in this report reflects overall economic growth, increasing the likelihood of the Federal Reserve tightening its monetary policy, which, in turn, has a bullish effect on the US dollar—assuming other factors remain constant. The remarkable liquidity of major currency pairs offers multiple advantages.

As trading volumes rise, transaction costs decline, allowing for tighter spreads in more liquid currency pairs. Moreover, greater liquidity contributes to the overall smoothing of volatility. Nonetheless, it’s essential to acknowledge that even the most liquid currencies can experience volatility under certain circumstances, which can be problematic for short-term Forex traders. Without adequate preparation or awareness of market volatility, significant capital losses may ensue.

Hence, professional Forex traders are strongly advised to implement robust risk management strategies to minimize potential risks. A stark example of extreme price volatility occurred when the USD/CHF currency pair experienced a sharp plunge in early 2015 following the Swiss National Bank’s decision to abandon its currency cap strategy.

In the years leading up to this event, the Swiss Franc’s safe-haven status, coupled with the eurozone debt crisis, led to substantial capital inflows into Switzerland. The Swiss National Bank opted to intervene in Forex markets by purchasing foreign currency to suppress the Swiss Franc’s value. When the SNB publicly renounced this policy, the Swiss Franc surged dramatically against all other currencies, causing the USD/CHF currency pair to plummet by 25% within minutes.

Instances of such extreme price shocks are exceedingly rare. In fact, liquid markets typically exhibit smoother price action, with sharp movements being more common in less liquid markets. The overall liquidity of the Forex market, especially major currency pairs, simplifies the execution of transactions compared to markets with thin liquidity, where entering or exiting a trade promptly can be challenging.

One potential drawback of Forex trading is the inability to secure regular, reliable, and fixed returns typically associated with other investment options like stocks or bonds. This depends on individual perspectives. While some traders find that Forex trading doesn’t justify the risks involved, others appreciate the market’s short-term nature, which can lead to substantial gains (or losses) in a relatively brief timeframe.

Ultimately, one’s outlook plays a pivotal role in determining whether to engage in Forex trading.

Major Forex Pairs: A Favorable Starting Point

Embarking on your Forex trading journey is best initiated by leveraging your existing knowledge. If you possess insights or familiarity with a particular economy, you may naturally gravitate toward trading its currency, even if it means delving into pairs beyond the majors. The benefits mentioned earlier, including tighter spreads and access to economic news and Forex analytics, position major currency pairs as an excellent entry point for many traders exploring the Forex market.

Frequently Asked Questions (FAQs) About Major Currency Pairs in Forex Trading

- What exactly is a currency pair in Forex trading?A currency pair in Forex trading is the combination of two different currencies, which are grouped together and traded against each other. These pairs represent the relative value of one currency in relation to the other. For example, the EUR/USD pair represents the Euro’s value compared to the US Dollar.

- Why are they called “major” currency pairs?Major currency pairs are called so because they consist of the most actively traded currencies in the world. These pairs are associated with countries with significant economic influence and stability. Traders commonly focus on them due to their high liquidity and availability of information.

- How do I read currency pairs in Forex trading?Currency pairs are read by looking at the exchange rate between the two currencies in the pair. For example, if the EUR/USD pair is quoted at 1.2000, it means one Euro is equal to 1.2000 US Dollars. The first currency in the pair is the base currency, and the second is the quote currency.

- What’s the difference between the bid and ask price in a currency pair?The bid price is the rate at which you can sell a currency pair, while the ask price is the rate at which you can buy it. The bid is typically lower than the ask, and the difference between the two is known as the spread. Brokers profit from this spread.

- Are major currency pairs the best choice for beginners?Major currency pairs are often recommended for beginners because they offer higher liquidity, tighter spreads, and more readily available information. These factors can make it easier for newcomers to start trading and learn the ropes.

- Why is liquidity important in Forex trading?Liquidity is crucial in Forex trading because it ensures that you can enter and exit trades easily. More liquid currency pairs tend to have smaller spreads and experience fewer extreme price fluctuations, providing a smoother trading experience.

- What are the advantages of trading major currency pairs?Trading major currency pairs offers advantages such as tighter spreads, access to extensive economic news and analysis, and increased liquidity. These factors can provide more trading opportunities and potentially lower trading costs.

- What are the disadvantages of trading major currency pairs?One disadvantage is that major currency pairs can be highly affected by economic news and events, leading to increased volatility. Traders need to stay informed and manage risks effectively. Additionally, major pairs may not always offer as high returns as trading more exotic or less popular pairs.

- Is Forex trading suitable for everyone?Forex trading can be highly rewarding but also involves substantial risks. It’s not suitable for everyone, especially those who are not prepared for the potential financial losses. It requires dedication, continuous learning, and risk management. It’s essential to understand your risk tolerance and only invest what you can afford to lose.

- Where can I practice Forex trading without risking real money?You can practice Forex trading with a demo account provided by most reputable brokers. Demo accounts allow you to trade with virtual funds, providing a risk-free environment to hone your skills and strategies before venturing into live trading.

Remember that Forex trading carries inherent risks, and it’s essential to educate yourself and consider seeking advice from financial experts before diving into the market.