Table of Contents

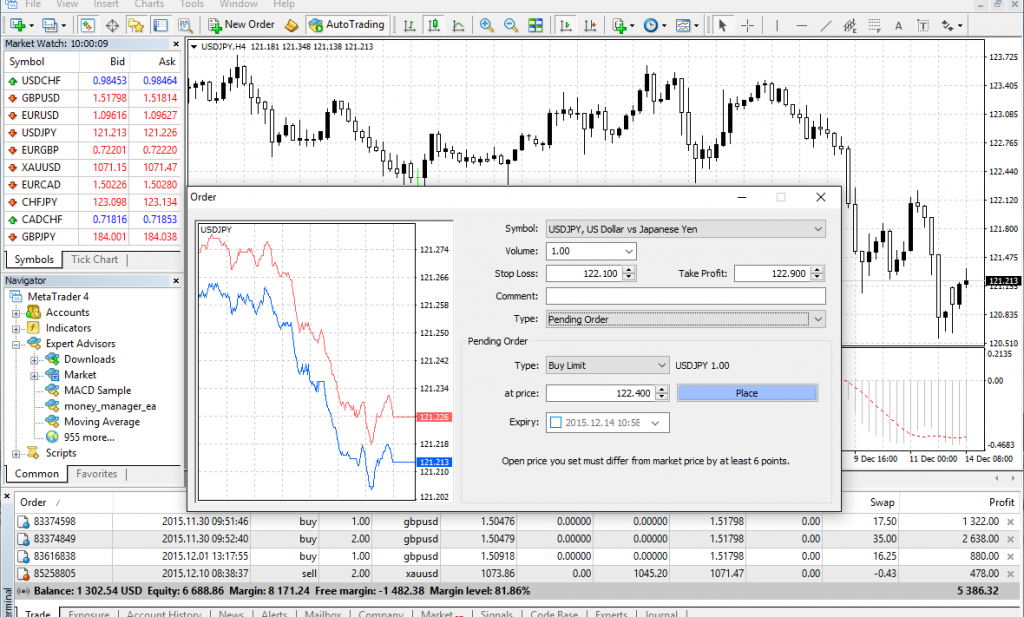

MetaTrader 4 Review: One of the most widely used and trusted platforms, MT4 offers a comprehensive set of tools, including advanced charting, technical indicators, and automated trading capabilities.

Is MetaTrader 4 Worth It in 2026? A Deep Dive Analysis

MetaTrader 4 (MT4) has been a staple in the trading world since its release in 2005. With its powerful features, extensive customization options, and user-friendly interface, MT4 quickly became the go-to platform for forex traders worldwide. However, in 2026, as technology advances and other trading platforms gain popularity, traders are asking: Is MT4 still worth using? Let’s dive deep into its relevance, advantages, and limitations.

The Enduring Appeal of MT4

- User-Friendly Interface: MT4’s intuitive design makes it a favorite among beginner and experienced traders. The platform’s simplicity ensures a smooth learning curve while offering advanced tools for seasoned professionals.

- Wide Broker Support: Over the years, MT4 has become synonymous with forex trading. Most brokers worldwide still support MT4, ensuring traders can access their accounts with ease.

- Customizability: One of MT4’s strongest features is its support for Expert Advisors (EAs) and custom indicators. This makes it highly adaptable to different trading styles and strategies.

- Lightweight and Reliable: Unlike some modern platforms that require significant system resources, MT4 remains lightweight, ensuring it runs smoothly even on older devices.

- Extensive Community and Resources: With nearly two decades of history, MT4 boasts an extensive community. This means traders have access to countless free and paid indicators, EAs, and tutorials.

MT4’s Limitations in 2026

- Outdated Technology: MT4 was built in a different era of trading. While it has received updates over the years, its core architecture is dated compared to newer platforms like MetaTrader 5 (MT5) or cTrader.

- Limited Asset Classes: MT4 primarily focuses on forex trading. For traders who deal with a broader range of assets, MT5 offers better support for stocks, commodities, and futures.

- Lack of Multi-Threading: Unlike MT5, MT4 doesn’t support multi-threading. This can be a drawback for traders who rely heavily on backtesting or running multiple EAs simultaneously.

- No More Official Updates: MetaQuotes, the developer of MT4, has shifted its focus to MT5. While MT4 is still operational, it no longer receives major updates, which could pose security and functionality risks in the future.

Comparing MT4 to Modern Alternatives

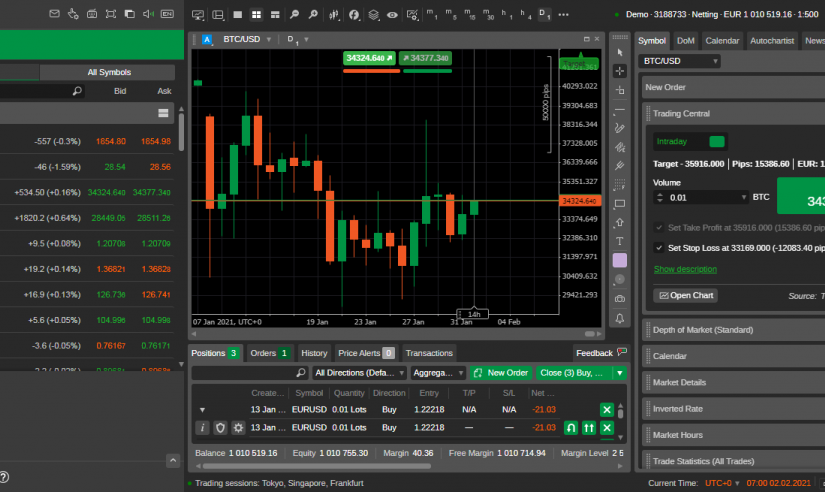

- MetaTrader 5 (MT5): The logical successor to MT4, MT5 offers several improvements, including multi-threading, a more extensive range of asset classes, and advanced order types. However, its adoption has been slower due to the entrenched user base of MT4.

- cTrader: Known for its sleek design and advanced charting tools, cTrader is gaining traction among traders looking for a modern alternative. It also provides features like Level II pricing and enhanced backtesting capabilities.

- TradingView: While primarily a charting tool, TradingView’s growing popularity stems from its intuitive interface and community-driven approach. Many brokers now offer direct integration with TradingView.

Should You Stick with MT4 in 2026?

Whether MT4 is worth it in 2026 depends largely on your trading needs:

- For Forex Traders: If you primarily trade forex and value simplicity, MT4 remains a solid choice. Its lightweight design and extensive community resources are unmatched.

- For Multi-Asset Traders: If you trade a diverse range of assets or need advanced features, consider upgrading to MT5 or exploring other platforms like cTrader.

- For Beginners: MT4’s ease of use makes it an excellent starting point for new traders. However, keep in mind the limitations you may face as you progress.

Final Thoughts

MT4’s longevity and popularity are a testament to its utility. While it may lack some of the bells and whistles of newer platforms, its reliability and extensive community support ensure it’s far from obsolete. In 2026, MT4 remains a worthwhile choice for many traders, though those seeking advanced features or broader asset class support may find better alternatives.

Ultimately, the decision hinges on your trading style, goals, and preferences. If you’re still on the fence, consider experimenting with demo accounts on MT4 and its competitors to find the best fit for your trading journey.

The Pros and Cons of MT4:

Pros:

- User-Friendly Interface: MT4 boasts an intuitive and user-friendly interface, making it suitable for traders of all experience levels. The platform’s layout is well-designed, allowing users to easily navigate through various features and functions.

- Advanced Charting Tools: MT4 offers a wide range of charting tools and technical indicators, enabling traders to conduct in-depth market analysis. It provides customizable chart templates, multiple timeframes, and various drawing tools to assist with technical analysis.

- Automated Trading: One of MT4’s standout features is its support for automated trading. Traders can develop and implement their own trading strategies using the platform’s built-in MetaQuotes Language (MQL), allowing for the creation of expert advisors (EAs) and custom indicators. This feature enables traders to execute trades automatically based on predefined conditions.

- Backtesting Capabilities: MT4 allows users to backtest their trading strategies using historical data, enabling traders to evaluate the performance of their strategies before applying them in live trading. This feature helps traders refine their strategies and identify potential strengths and weaknesses.

- Vast Market Coverage: MT4 provides access to a wide range of financial markets, including forex, commodities, indices, and CFDs (Contract for Difference). Traders can trade multiple assets from a single platform, enhancing convenience and efficiency.

Cons:

- Limited Compatibility: While MT4 is available for Windows-based devices, it has limited compatibility with other operating systems. Mac users, for example, may need to rely on third-party software or virtualization tools to run MT4 on their devices.

- Dated User Interface: Compared to newer platforms, MT4’s user interface may feel somewhat outdated. Some traders may prefer a more modern and visually appealing design, which is offered by newer platforms like MetaTrader 5 or other competing platforms.

- Lack of Depth in Market Analysis: While MT4 provides a solid set of charting tools and indicators, it may not offer the same level of depth and complexity as some other platforms. Traders who require advanced analysis tools or access to a wider range of indicators may find MT4 somewhat limited in this regard.

- Limited Order Types: MT4 supports basic order types such as market orders, limit orders, stop orders, and trailing stops. However, it lacks more advanced order types like OCO (One Cancels the Other) or IF-Done orders, which may be a disadvantage for some traders with specific trading strategies.