Table of Contents

What Is a Trailing Stop? How to Use Trailing Stop In MetaTrader 5 (MT5). One popular tool that traders use to protect their profits and minimize losses is the trailing stop. The trailing stop is a dynamic stop-loss order that adjusts itself automatically as the trade moves in the trader’s favor. In this article, we will explore what a trailing stop is, its benefits, and how to use it with the MT5 (MetaTrader 5) trading platform.

What is a Trailing Stop?

A trailing stop is a type of stop-loss order that follows the price movement of an asset, allowing traders to secure profits while giving the trade room to develop further. Unlike a traditional stop-loss order, which remains fixed at a specific price level, a trailing stop moves with the market, adjusting the stop level as the trade becomes more profitable. The trailing stop helps traders lock in gains and protect against potential reversals.

Benefits of Using a Trailing Stop

- Protecting Profits: One of the key benefits of a trailing stop is its ability to protect profits. As the trade moves in the trader’s favor, the trailing stop automatically adjusts to lock in gains. This feature allows traders to let their winners run while protecting against sudden market reversals.

- Minimizing Losses: Trailing stops also help minimize losses. If the trade starts moving against the trader, the trailing stop will activate once the market price reaches a specified distance from the highest point reached. This allows traders to exit the trade with a predefined loss, preventing further damage to their trading capital.

- Reducing Emotional Bias: By using a trailing stop, traders can remove some of the emotional bias from their decision-making process. The trailing stop is executed automatically based on predefined parameters, taking the trader’s emotions out of the equation. This feature helps traders stick to their trading plan and avoid making impulsive decisions.

Example of a Trailing Stop

Let’s consider an example to understand how a trailing stop works. Assume a trader enters a long position on a currency pair at 1.2000 with an initial stop loss at 1.1950 and a trailing stop distance of 50 pips. As the trade moves in the trader’s favor, the trailing stop adjusts automatically. If the price reaches 1.2050, the trailing stop will move to 1.2000, locking in a 50-pip profit. If the price continues to rise and reaches 1.2100, the trailing stop will move again to 1.2050, securing a 100-pip profit. However, if the price reverses and hits the trailing stop level, the trade will be closed at 1.2050, resulting in a 50-pip profit.

How to Setup Trailing Stop In MetaTrader 5

Setting up a trailing stop in MetaTrader 5 (MT5) is a relatively straightforward process. Here’s a step-by-step guide on how to do it:

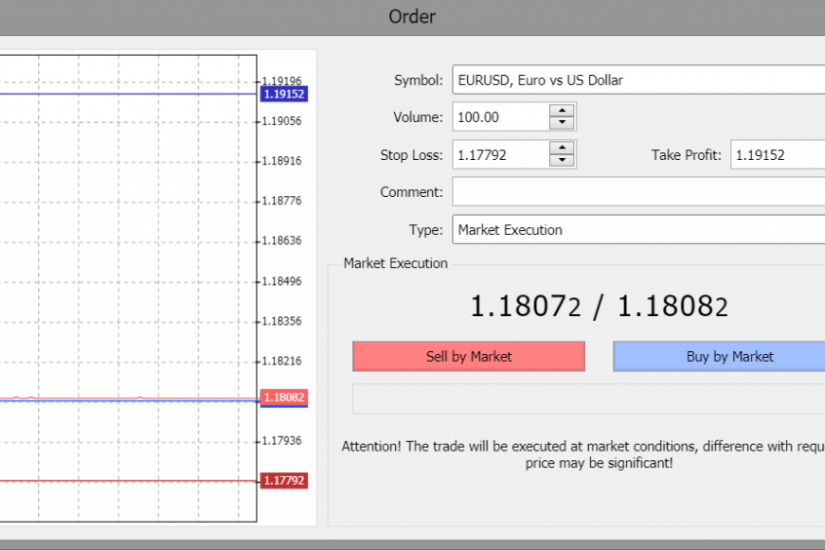

- Open MetaTrader 5: Launch the MT5 trading platform on your computer.

- Select the Trade tab: At the bottom of the platform, you’ll find several tabs. Click on the Trade tab to view your open positions and trading activity.

- Locate the position you want to set the trailing stop for: In the Trade tab, you’ll see a list of your current trades. Find the specific position for which you want to set up a trailing stop.

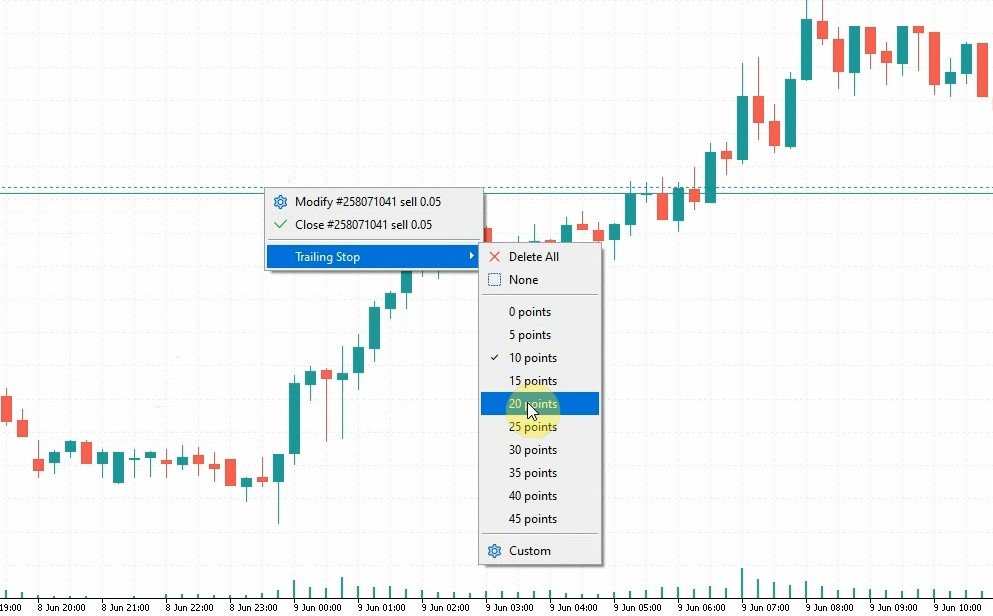

- Right-click on the position: Once you’ve found the desired position, right-click on it to access the context menu.

- Choose Trailing Stop: From the context menu, select the option labeled Trailing Stop. This will open a dialog box with trailing stop settings.

- Specify the trailing stop parameters: In the dialog box, you’ll be able to customize the parameters for your trailing stop. The options typically include the distance or offset from the current market price at which the trailing stop should activate. You can specify this distance in pips or points.

- Confirm the settings: Once you’ve defined the trailing stop parameters, click the OK button to confirm and activate the trailing stop for the selected position.

That’s it! You have successfully set up a trailing stop for your position in MT5. The trailing stop will now automatically adjust as the trade moves in your favor, protecting your profits while allowing for potential further gains.

It’s important to note that the trailing stop feature is available for open positions only. If you close the position or if it gets stopped out, the trailing stop will no longer be active for that specific trade.

Remember, it’s crucial to test and familiarize yourself with trailing stops using a demo account before implementing them in live trading. This will help you understand how trailing stops work and how to use them effectively in different market conditions.

Conclusion

A trailing stop is a valuable tool for forex traders to manage risk and protect profits. By dynamically adjusting the stop-loss level as the trade progresses, traders can secure gains while allowing the trade to develop further. MT5 offers an easy-to-use interface for setting up trailing stops, empowering traders to implement effective risk management strategies. Remember, it is essential to understand the concept and practice using a trailing stop on a demo account before applying it to live trading.