Table of Contents

Calculating Stop Loss & Take Profit in MetaTrader 5: Calculating appropriate stop loss and take profit levels is crucial for effective risk management and profit optimization in forex trading. MetaTrader 5 (MT5) offers traders a range of tools and features to accurately determine these levels. In this article, we will explore various methods for calculating stop loss and take profit levels in MT5 to enhance trading performance.

How to Set Stop Loss Orders in MetaTrader 5 (MT5)

Percentage-based Approach

One commonly used method for calculating stop loss & take profit in MetaTrader 5 is the percentage-based approach. Traders determine a percentage of the entry price that they are willing to risk as a stop loss, and a percentage of the entry price that they aim to achieve as a take profit.

For example, if a trader decides to risk 2% of their trading capital on a trade, they can set their stop loss level at 2% below the entry price. Similarly, if they aim to achieve a 4% profit, they can set their take profit level at 4% above the entry price.

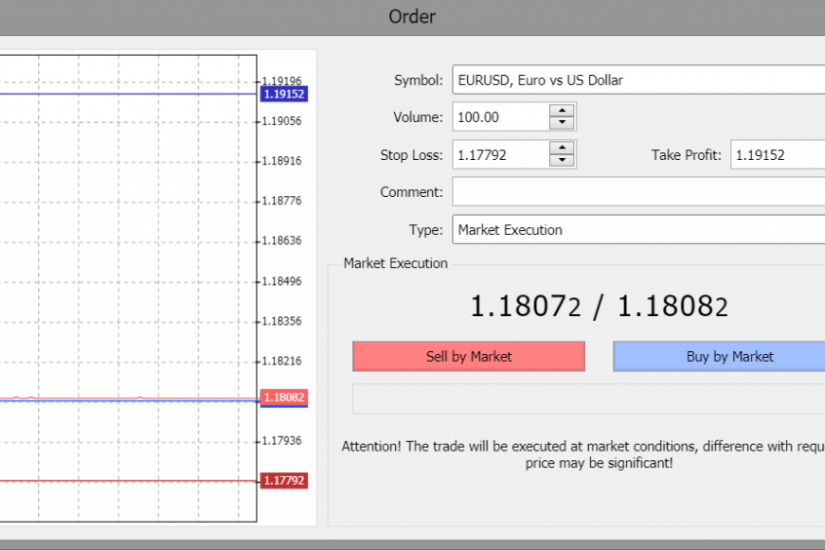

MT5 allows traders to easily calculate these levels by using the built-in calculator or by manually inputting the desired percentages in the order modification window.

Average True Range (ATR) Method

The Average True Range (ATR) indicator is widely used to measure market volatility. Traders can leverage ATR to calculate stop loss and take profit levels based on the current market conditions.

By multiplying the ATR value by a predetermined factor, traders can determine the appropriate distance to set their stop loss and take profit levels. For example, if the ATR value is 50 pips and the trader decides to use a 2x ATR factor, they can set their stop loss and take profit levels at 100 pips above and below the entry price, respectively.

MT5 provides the ATR indicator, which can be easily applied to the charts. Traders can adjust the ATR factor based on their risk tolerance and market conditions.

Support and Resistance Levels

Support and resistance levels are significant price levels that tend to act as barriers or turning points in the market. Traders can use these levels to calculate stop loss and take profit levels.

For long positions, the stop loss level can be placed slightly below a relevant support level. This helps protect against potential downward movements. For take profit levels, traders can target a resistance level where price tends to reverse or encounter selling pressure.

In MT5, traders can identify support and resistance levels using technical analysis tools and draw them on the charts. The distance between the entry price and these levels can be used to calculate the appropriate stop loss and take profit levels.

Fibonacci Retracement Levels

Fibonacci retracement levels are based on the Fibonacci sequence and are often used to identify potential support and resistance levels in the market. Traders can use these levels to calculate stop loss and take profit levels.

By drawing Fibonacci retracement levels from significant price swings, traders can identify potential levels where price may reverse or encounter support/resistance. The distance between the entry price and these levels can be used to determine the stop loss and take profit levels.

MT5 provides Fibonacci retracement tools that can be easily applied to the charts. Traders can use these tools to calculate the appropriate stop loss and take profit levels based on Fibonacci retracement levels.

Conclusion

Calculating stop loss and take profit levels is a crucial aspect of forex trading. By utilizing various methods such as the percentage-based approach, ATR method, support and resistance levels, and Fibonacci retracement levels, traders can accurately determine these levels and effectively manage their risk and optimize profits.

MT5 offers a range of tools and features that facilitate the calculation and placement of stop loss and take profit levels. By incorporating these calculations into their trading strategies,