Table of Contents

How to Become a Forex Trader: Forex trading is a captivating venture, offering both opportunities and risks. Many aspire to be successful Forex traders, but the reality is that a significant percentage end up losing more than they gain. Mastering Forex trading is a gradual process that demands dedication and continuous learning.

In this article, we’ll guide you on the journey to becoming a Forex trader and provide essential tips for both beginners and experienced traders.

Introduction to a Forex Trader

A Forex trader is an individual who executes financial market orders, either independently or on behalf of financial institutions such as banks, investment funds, or hedge funds. They handle various asset classes like Forex, equities, bonds, and commodities. Traders working for financial institutions trade on behalf of clients, while independent traders use their own capital and trade through online platforms.

Defining Success as a Forex Trader

Before diving into Forex trading, it’s crucial to set clear goals and define success. Here are some key considerations:

- Establish realistic, quantifiable goals, such as achieving a 20% annual return or gaining 100 pips per month.

- Goals should be measurable and set for a more extended time frame, preferably annually.

- Assess available resources, including your initial deposit, trading intentions (full-time or part-time), and risk appetite.

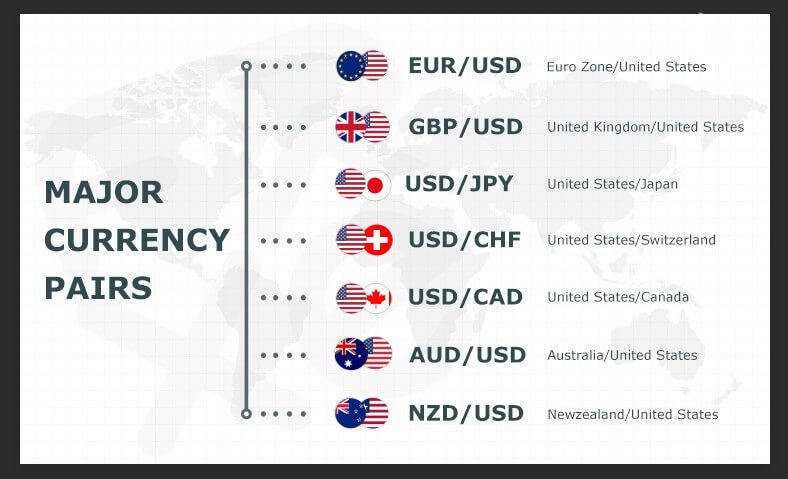

Once your vision is clear, create an action plan, specifying the currency pairs you intend to trade and the number of daily trades.

Top 10 Tips on How to Become a Forex Trader

1. Manage Your Expectations

Managing your expectations is the cornerstone of a successful Forex trading journey. It’s crucial to understand that Forex trading is not a guaranteed path to quick riches. Many aspiring traders enter the market with unrealistic expectations of doubling their investments in a matter of days. However, such expectations often lead to emotional decision-making and excessive risk-taking.

Instead, approach Forex trading with a realistic mindset. Recognize that consistent profitability in trading takes time, education, and practice. Set achievable goals, such as aiming for a modest annual return on your investment or a specific number of pips per month. By setting attainable targets, you reduce the pressure to perform unrealistically and make room for steady progress.

2. Define Your Trading Risk Profile

Every trader has a unique risk profile, which reflects their willingness and capacity to take on risk. It’s vital to evaluate your risk tolerance before engaging in Forex trading. Your risk profile influences various aspects of your trading strategy, including position sizing and risk management.

Assess your capital and determine how much you can comfortably invest in Forex trading without jeopardizing your financial stability. Consider your financial goals, time horizon, and whether you intend to trade full-time or part-time. Understanding your risk profile will help you make informed decisions about the markets you trade, the size of your positions, and the level of leverage you employ.

3. Choose a Trading Strategy

Selecting a trading strategy is a critical step in your journey to becoming a successful Forex trader. There’s no one-size-fits-all approach to trading, and what works for one trader may not work for another. Your chosen strategy should align with your risk profile and trading objectives.

Start by exploring different trading styles, such as day trading, swing trading, or position trading, to find the one that suits your personality and schedule. Once you’ve identified your preferred style, develop a specific trading strategy within that framework. Consider technical and fundamental analysis tools, indicators, and chart patterns that resonate with your approach.

Remember that your trading strategy is not static; it should evolve and adapt as market conditions change. Backtest your strategy thoroughly to gain confidence in its effectiveness before implementing it in live trading.

4. Control Your Emotions

Emotional control is a pivotal aspect of successful Forex trading. The market can evoke a range of emotions, including fear, greed, excitement, and frustration. Emotions often lead to impulsive decisions that can result in significant losses.

To maintain emotional discipline, follow these steps:

- Stick to your trading plan: A well-defined plan helps you avoid impulsive actions.

- Practice mindfulness: Be aware of your emotions while trading and take breaks when needed.

- Manage stress: Implement stress-reduction techniques, like deep breathing or meditation, to stay calm during volatile market conditions.

- Avoid overconfidence: Winning streaks can lead to overconfidence, which may result in excessive risk-taking. Stay objective and adhere to your strategy.

5. Use Stop Losses and Take Profits

Managing risk is fundamental in Forex trading, and the use of stop losses and take profits is a key component of risk management. A stop loss is a predetermined price level at which you exit a losing trade to limit potential losses. A take profit order sets a predefined profit level at which you exit a winning trade to secure gains.

These orders help you maintain discipline and prevent emotional decision-making. By using stop losses and take profits, you ensure that your trades have predefined risk-reward ratios. Be aware that stop losses are not guaranteed to execute at the exact price in fast-moving markets due to slippage, so it’s essential to monitor your trades.

6. Keep Up With the Markets

Staying informed about market developments and news is vital for successful Forex trading. Market movements are often influenced by economic events, central bank decisions, geopolitical developments, and more. Even if you primarily use technical analysis, fundamental news can have a significant impact on your trades.

To keep up with the markets:

- Use economic calendars to track important events and announcements.

- Subscribe to financial news websites or newsletters for timely updates.

- Understand the correlation between news and market movements in your chosen currency pairs.

Being well-informed helps you make informed trading decisions and adapt your strategies to changing market conditions.

7. Do Not Overtrade

Overtrading is a common pitfall that can lead to significant losses. It occurs when traders excessively enter and exit positions, driven by the desire to make quick profits. Overtrading can result in high transaction costs, emotional exhaustion, and a higher risk of significant drawdowns.

To avoid overtrading:

- Stick to your trading plan and predefined strategies.

- Set daily or weekly trading limits to prevent excessive activity.

- Wait for high-probability trading opportunities and avoid impulsive trades.

Remember that quality, not quantity, is the key to successful trading.

8. You Are Going to Lose Eventually

Losing is an inevitable part of Forex trading, even for experienced traders. Understanding and accepting this fact is crucial for your psychological well-being as a trader. In reality, no trader can claim a flawless record without any losing trades.

Successful traders focus on ensuring that their profitable trades outweigh their losses over time. They manage risk diligently and view losses as opportunities to learn and improve their strategies. By embracing losses as part of the journey, you can maintain a resilient and positive trading mindset.

9. Develop a Trading Plan

A well-structured trading plan is your roadmap to success in Forex trading. It serves as a comprehensive guide that outlines your trading objectives, risk management rules, entry and exit strategies, and trade management protocols.

Your trading plan should cover:

- Clear entry and exit criteria.

- Risk management rules, including position sizing and leverage usage.

- Guidelines for handling losses and drawdowns.

- Strategies for adapting to changing market conditions.

- Regular reviews and adjustments to your plan as needed.

A disciplined adherence to your trading plan helps you stay focused, reduce emotional trading, and maintain consistency in your approach.

10. Choose the Right Broker

Selecting the right Forex broker is a critical decision that impacts your trading experience and safety. The Forex broker you choose should align with your trading needs and provide a secure and transparent trading environment.

Key considerations when choosing a broker include:

- Regulatory compliance: Ensure the broker is licensed and regulated by a reputable authority.

- Fund protection: Verify how your funds are safeguarded, including segregation from the broker’s operational capital.

- Customer service: Assess the quality and responsiveness of customer support.

- Trading platform: Evaluate the broker’s trading platform for user-friendliness and features.

- Compatibility with your trading style: Ensure the broker caters to your chosen trading style (e.g., scalping, swing trading).

Thorough research and due diligence are essential when selecting a broker to ensure a safe and conducive trading environment.

Mastering these ten aspects of Forex trading will significantly enhance your chances of becoming a successful and profitable trader over time. Remember that trading is a continuous learning process, and the ability to adapt and refine your skills is key to long-term success.

Frequently Asked Questions (FAQs)

1. Can I become rich quickly through Forex trading?

No, becoming rich quickly in Forex is highly unlikely and unrealistic. Trading should be approached with a focus on consistent, sustainable profits rather than rapid wealth accumulation.

2. How can I control my emotions while trading?

Emotional control in trading can be achieved through disciplined adherence to a well-defined trading plan, ongoing education, and psychological strategies like mindfulness and stress management.

3. Is there a guaranteed way to avoid losses in Forex trading?

No, losses are an inherent part of Forex trading. Even experienced traders incur losses. The key is to ensure that your profitable trades outweigh your losses over time.

4. What should I look for when choosing a Forex broker?

Look for a broker that is licensed and regulated, offers investor protection, responsive customer service, and provides a user-friendly trading platform. It’s crucial to research and choose a broker that aligns with your needs and preferences.

5. How can I stay updated with market news and events?

You can stay informed by regularly checking economic calendars, financial news websites, and subscribing to market analysis newsletters or services. Many trading platforms also provide real-time news updates.

6. Is it necessary to diversify my investments in Forex trading?

Diversification is a risk management strategy that can reduce the impact of potential losses. It’s advisable not to invest more than 20% of your total capital in a single market to spread risk effectively.

7. Can I trade Forex part-time or do I need to be a full-time trader?

You can trade Forex part-time or full-time, depending on your goals and availability. Many traders start part-time while maintaining other sources of income. The choice depends on your preferences and circumstances.